- Transacted

- Posts

- Turnaround

Turnaround

CalPERS transforms private equity strategy and performance

PRESENTED BY TRAINING THE STREET

Transacted

January 29, 2026

Happy Thursday. Here’s what we’ve got today…

A look at CalPERS’ private equity reset

Plus, CVC’s deal to build its US private credit platform

Get Your New Hires Deal-Ready - Fast

Private equity, investment banking, and finance teams cannot afford a long learning curve. Training The Street’s Core Comprehensive program transforms new hires into analysts and associates who can contribute quickly - improving speed and performance while reducing senior training time and lowering execution risk.

Trusted by leading PE firms and banks, the program equips junior talent with practical modeling, valuation, and Excel skills required to produce high-quality work from day one on the desk.

Core Comprehensive provides a consistent foundation that helps teams ramp faster and add value with confidence.

Your team will be equipped to:

Apply advanced Excel best practices to produce clean, efficient analysis

Build integrated financial models and apply valuation methodologies used in live deal environments

Evaluate M&A and LBO structuring and returns models

Register today to secure early-bird pricing, with in-person and virtual programs available across the globe and throughout the year.

Turnaround:

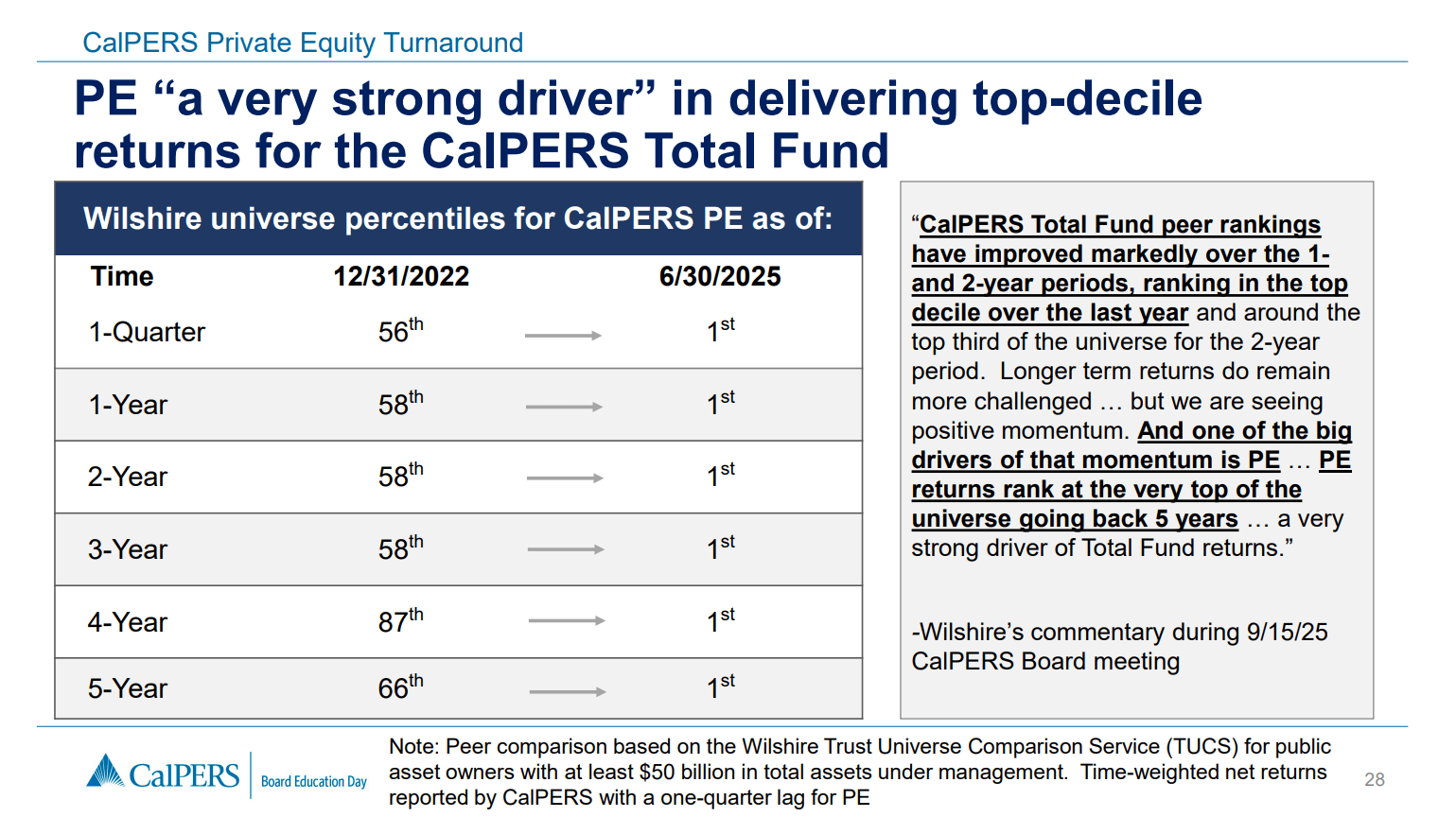

The California Public Employees' Retirement System's private markets program transformation has taken the $500 billion fund from dead last among its peers to the top of performance rankings in three years.

The turnaround, detailed in a board presentation last week by Anton Orlich, managing investment director of private equity, has focused on three core objectives: a rebalancing away from large buyouts toward venture and growth, a rethink of co-investment prioritization, and a commitment to steady deployment.

CalPERS' $98 billion private equity portfolio returned 7.4 percent annually in the three years ended June 2025, ranking first among the 30 largest US public pension systems. As recently as December 2022, the fund sat at the bottom of that same peer group.

The CalPERS Private Equity Turnaround, Board of Administration Educational Day, January 20, 2026

In 2024, CalPERS' board voted to raise the fund's private equity allocation from 13 percent from to 17 percent. But, within that allocation, CalPERS has cut its commitments to buyout funds to 58 percent of total private capital, down from 91 percent three years earlier.

The delta has been allocated to growth equity—now 31 percent of fund commitments, up from 9 percent in fiscal 2022—and a new venture capital program that received 12 percent of commitments in fiscal 2024.

"Growth and venture don't just have higher returns on average, they also have some diversification from buyout," Orlich told the board.

Within the remaining buyout allocation, CalPERS has moved away from large-cap funds and prioritized smaller managers.

Middle market funds are now 57 percent of buyout commitments, up from 40 percent in fiscal 2022.

Middle market strategies historically generate stronger returns than large-cap buyout, but the shift is also about maximizing leverage as an LP. In smaller vehicles, CalPERS' capital is a much larger share of the total fund, which gives the pension greater influence over general partner behaviour.

Supporting the new approach, a revision to CalPERS' concentration governance now permits the pension to take positions of up to 35 percent of a fund, up from 25 percent previously.

In part, the moves are also about avoiding public relations crises.

CalPERS, along with other public pensions, has had to manage what board president Theresa Taylor described as concerns about "buyouts and corporate restructuring" from constituents and politicians.

In the fund's view, large-cap buyout strategies disproportionately involve mature companies where workforce reductions and pension modifications are more common.

"It kind of reminds me of the old corporate hostile takeovers of the 80s and 90s," said Taylor.

That's part of the reason, says Orlich, that all incremental dollars from the fund's recent private capital allocation change have gone toward venture and growth, not buyout.

"On average, where would something be more likely to show up as a problem? I would imagine it would be with buyout," Orlich acknowledged. "We dramatically diversified the portfolio away from those transactions."

In buyouts, CalPERS says it prioritizes these concerns as part of its manager diligence process and its participation in limited partner advisory committees (where it now holds more sway with its middle market focus).

"We are looking out for these kinds of investments that hurt the workforce. We have some managers that we had really high confidence in, and they have proven not to be so reliable, and these are larger names," added Taylor.

—

Co-investment growth is a key target for many LPs, who see an attractive opportunity to reduce the fee burden from standard commitments. Taking a slightly different approach, CalPERS has deprioritized overall coinvestment allocation in favor of opportunity selection.

"In 30 years of investing, we actually had an outcome where our co-investments underperformed our funds in most periods, even on a net basis," Orlich said. "That's something that we've been able to reverse in the last three years."

That's meant a shift away from a philosophy that pursued co-investment opportunities with every manager relationship.

"We start with the foundation of manager selection and invest in what we think are the best funds, and then we selectively participate in co-investments where we think we are doubling down on the best opportunities that are provided by those funds," he explained, adding that doing co-investments "for the sake of it" exposes limited partners to adverse selection risk.

CalPERS’ co-investments now outperform the underlying fund portfolios even on a gross basis.

"We're capturing the full fee and carry savings and then adding a little bit of outperformance from the deal selection," Orlich said.

But in a challenging fundraising market, CalPERS’ new selectivity hasn't hurt overall co-investment allocation.

The pension now hits a 40 percent co-investment rate against its $15.5 billion annual commitment budget—a target it had missed in the three fiscal years prior to the launch of its turnaround strategy.

The economics: each $1 billion deployed via co-investment instead of fund commitments saves around $400 million in management fees and carried interest over the life of the investments. At current deployment rates, that's around $25 billion in fee savings over a ten-year period.

—

Perhaps the most consequential strategy shift is CalPERS’ commitment to sustained private markets deployments across market cycles — a response to the fund's disastrous "lost decade."

In 2006 and 2007, CalPERS made $24 billion in new commitments to private capital. After being burned by the subsequent financial crisis, the fund retreated over the following decade—sitting on the sidelines during a historically strong run for the asset class.

The result was an estimated $11 billion to $18 billion in foregone returns.

As part of the 2024 vote to increase the fund's private capital allocation, CalPERS also formalized its intent to prioritize consistent deployment regardless of market conditions. The fund has now committed around $15.5 billion in each of the past three fiscal years, avoiding outsized exposure to the challenged 2020 and 2021 vintages that have caused issues for some peers.

—

CalPERS' private markets turnaround has made impressive progress in a relatively short time, though it's still early days. Orlich, however, is confident in sustained improvement:

"The team has internalized the strategy, and there is shared ownership over the portfolio," he told a board member. "We have done very well with our manager selection and have gotten our process to a point where it's repeatable. We've done very well with our co-investment selection—that is also repeatable."

At the very least, CalPERS' jump to the top of the benchmarking table is proof that something's working.

DEALS, DEALS, DEALS

• CD&R has hired advisers to sell Indicor, an industrial business partially owned by Roper Technologies (Nasdaq: ROP), which could be valued at $6 billion, per the FT.

• Blackstone and Yanmar Holdings are among the potential bidders for a majority stake in Everllence, Volkswagen's heavy diesel engine unit, which could be valued at nearly €5 billion, per Bloomberg.

• York Space Systems (NYSE: YSS), a Denver-based small satellite manufacturer backed by AE Industrial Partners, raised $629 million in its upsized IPO priced at $34 per share, valuing the company at $4.3 billion.

• Permira has launched a sale process for Neuraxpharm, a German pharmaceutical company specializing in central nervous system disorders, which could be valued at between €3 billion and €4 billion, per Bloomberg.

• Stonepeak agreed to invest $2.4 billion for a 25% stake in United Ports LLC, a new joint venture with CMA CGM operating 10 container terminals across the U.S., Brazil, Spain, and Asia.

• Leidos (NYSE: LDOS) agreed to acquire ENTRUST Solutions Group, an engineering solutions provider for utilities, for approximately $2.4 billion in cash from Kohlberg & Co.

• VSE Corporation (Nasdaq: VSEC) agreed to acquire Precision Aviation Group, a provider of aviation aftermarket services, for $2.03 billion from GenNx360 Capital Partners.

• Forgent Power Solutions, a data center electrical equipment manufacturer backed by Neos Partners, launched an IPO to raise up to $1.62 billion targeting a valuation of around $8.8 billion.

• Prosperity Bancshares (NYSE: PB) agreed to acquire Stellar Bancorp (NYSE: STEL), a Houston-based commercial bank, for $2 billion in cash and stock.

• IonQ (NYSE: IONQ) agreed to acquire SkyWater Technology (Nasdaq: SKYT), a U.S.-based semiconductor foundry, for approximately $1.8 billion in cash and stock.

• Stanley Electric agreed to acquire Iwasaki Electric, a Japanese provider of light sources and lighting fixtures, from Carlyle for ¥70.3 billion.

• Nordic Capital agreed to acquire a majority stake in 1741 Group, a Swiss provider of investment fund structuring and administration services.

• Thyssenkrupp is considering the sale of a roughly 30 percent stake in Rothe Erde, its bearings business, in a deal that could value the unit at about €1.5 billion, per Bloomberg.

• Audax Group has hired JPMorgan to explore a sale of BlueCat Networks, a Toronto-based cybersecurity provider, which could be valued at more than $1.5 billion, per Reuters.

• Anta Sports agreed to acquire a 29 percent stake in Puma, a German sportswear brand, for €1.5 billion from Groupe Artémis.

• Bridgepoint and Triton Partners are considering a potential £1.5 billion takeover of Spire Healthcare (LSE: SPI), the UK's largest private hospital group, per Sky News.

• CVC Capital Partners agreed to acquire Marathon Asset Management, a US credit manager, for up to $1.2 billion in cash and equity.

• Waterland Private Equity has hired Houlihan Lokey to explore a sale of Xebia, a Dutch AI and digital transformation consultancy that could be valued at more than €1 billion, per Bloomberg.

• AEA Elevate acquired a majority stake in 829 Studios, a Boston-based digital marketing firm, from CIVC Partners.

• ETS is exploring a sale of its GRE and TOEFL standardized testing assets, which could be valued at around $500 million, per The Wall Street Journal.

• Kodiak Solutions, a portfolio company of TPG, acquired Besler, a Princeton, New Jersey-based provider of revenue recovery and hospital reimbursement solutions.

• Conscious Capital Growth and Petra Capital Partners acquired RD Nutrition Consultants, a national provider of clinical nutrition and dietitian consulting services.

• Blackstone agreed to acquire Arlington Industries, a designer and manufacturer of electrical products including fittings and enclosures.

• Universal Music Group acquired a minority stake in Stationhead, a social music streaming platform, alongside Sterling Partners.

• Excellere Partners acquired Hinterland Group, a Riviera Beach, Florida-based provider of underground water infrastructure maintenance and repair services.

• Rover Group, a portfolio company of Blackstone, acquired Meowtel, a cat-sitting marketplace backed by Hustle Fund, SaaSCraft Ventures, and Hands On Angel.

• Southfield Capital acquired Contextual.io, a Guilford, Connecticut-based AI orchestration platform for enterprise solutions.

• The Chernin Group acquired a minority stake in Goalhanger, the UK-based podcast studio behind "The Rest Is History" and "The Rest Is Football".

• Siegfried Holding AG agreed to acquire Noramco, Extractas Biosciences, and Purisys, the controlled drug substance businesses of the Noramco Group, from SK Capital Partners.

• Tecum Capital and Inyarek Partners acquired F.A. Days & Sons, a Massachusetts-based propane supplier, to launch Guardian Propane Partners, a retail propane distribution platform.

• KPS Capital Partners agreed to acquire a controlling stake in Novacel, a French manufacturer of surface protection solutions, from Compagnie Chargeurs Invest.

• Accel-KKR invested in Exxat, a Warren, New Jersey-based provider of technology for clinical and experiential healthcare education.

• JLL Partners acquired PowerParts Group, a provider of aftermarket parts and field services for gas and steam turbines, from Mangrove Equity Partners.

• Brentwood Associates and Tenex Capital Management recapitalized Perennial Services Group, a Pittsburgh-based provider of lawn care, pest control, landscaping, and arbor services.

• NOCD acquired Rebound Health, a virtual trauma and PTSD therapy provider.

• Incline Equity Partners acquired MCCi, a Tallahassee, Florida-based provider of enterprise content management and workflow automation software for the public sector, from Century Park Capital Partners.

• AutoManager, a portfolio company of The Beekman Group, acquired Macrosmith, a State College, Pennsylvania-based automotive document management software provider.

• Main Post Partners acquired HomeWell Care Services, a franchisor of non-medical in-home senior care.

• Resonetics, backed by Carlyle and GTCR, agreed to acquire Resolution Medical, a Minnesota-based manufacturer of complex medical devices, from Arcline Investment Management.

• Healthcare Holding Schweiz, managed by Winterberg Advisory and KKA Partners, acquired PlusORTHO Prothetik, a Swiss provider of orthopedic hand, foot, and knee implants and fixation systems.

• Specialized Elevator, a portfolio company of Berkshire Partners, merged with Vintage Elevator Services, a San Francisco Bay Area-based provider of commercial and residential elevator services.

• Capstreet acquired TOPS Field Services, a Texas-based provider of inspection, overhaul, and maintenance services for gas and steam turbines, LNG equipment, and generators.

• Pavement Preservation Group, a portfolio company of The Sterling Group, acquired Holbrook Asphalt and Integrated Pavement Solutions, providers of pavement preservation services.

• Vireo Growth agreed to acquire Hawthorne Gardening, a provider of nutrients, lighting, and hydroponic gardening materials, from Scotts Miracle-Gro (NYSE: SMG).

• Adenia Partners agreed to acquire a majority stake in Parkville Pharmaceuticals, a Cairo-based pharmaceutical company, from Admaius Capital Partners and Dr. Sherif Bassiouny.

• LKQ Corporation (Nasdaq: LKQ), an auto parts supplier, has initiated a review of strategic alternatives, including a potential sale, with Bank of America advising.

• PaperTech, a portfolio company of May River Capital, acquired Bake-Best Trays, an Oregon-based manufacturer of pressed paperboard trays for food applications.

• Pollen Street Capital agreed to acquire Thesis Holdings, a UK-based fund services platform, from Ventiga Capital Partners, J Leon, and management.

• Gordon Brothers acquired LK Bennett, a UK-based premium womenswear, footwear, and accessories brand, out of administration.

• Bain Capital acquired APP Jet Center, a network of five FBOs providing aviation services, from Ridgewood Infrastructure.

• RESA Power, a portfolio company of Kohlberg & Company, acquired Société Générale d'Électrotechnique, a Quebec City-based provider of electrical energy solutions.

• Rubicon Technology Partners acquired a majority stake in Procede Software, a Solana Beach, California-based provider of dealer management systems for the commercial vehicle industry.

• Liberty Mutual Investments acquired a minority stake in Mascarene Partners, a New York-based middle-market private equity firm focused on North American transportation and industrials.

• The Amlon Group, a portfolio company of Heartwood Partners, acquired Mastermelt America, a Sweetwater, Tennessee-based processor of industrial waste containing precious metals and superalloys.

• Frontline Road Safety, a portfolio company of Bain Capital, acquired American Roadway Logistics, a Norton, Ohio-based pavement marking and traffic maintenance provider, from Monroe Street Partners.

• Bain Capital and Blackstone have advanced to the second round of bidding for Vitabiotics, a UK-based vitamin maker, alongside EQT and TPG, per Bloomberg.

VENTURE & EARLY-STAGE

Tech, Vertical SaaS, & Misc. Enterprise

• Ricursive Intelligence, an AI chip design lab, raised $300 million in Series A funding at a $4 billion valuation led by Lightspeed, with participation from DST Global, NVentures, Felicis Ventures, 49 Palms Ventures, Radical AI, and Sequoia Capital.

• Decagon, an AI customer support agent platform, raised $250 million in Series D funding at a $4.5 billion valuation, co-led by Coatue Management and Index Ventures, with participation from ChemistryVC, Definition Capital, Starwood Capital, Andreessen Horowitz, A*, Accel, Avra, Bain Capital Ventures, Forerunner, and Ribbit Capital.

• Upwind, a cloud security platform for runtime threat detection, raised $250 million in Series B funding at a $1.5 billion valuation led by Bessemer Venture Partners, with participation from Salesforce Ventures, Picture Capital, Greylock Partners, Cyberstarts, Leaders Fund, Sheva, and Craft Ventures.

• Flapping Airplanes, a data-efficient AI research lab, raised $180 million in seed funding at a $1.5 billion valuation co-led by GV, Sequoia Capital, and Index Ventures, with participation from Menlo Ventures.

• Factify, an AI-native document standard developer, raised $73 million in seed funding led by Valley Capital Partners.

• Eliyan, a chiplet interconnect developer for AI and high-performance computing, raised $50 million in strategic Series C funding from AMD, Arm, Coherent, Meta, Samsung Catalyst Fund, and Intel Capital.

• Summize, an AI contract lifecycle management platform, raised $50 million in Series A funding led by Maven Capital Partners, with participation from YFM Equity Partners, Kennet Partners, and Federated Hermes Private Equity.

• Compa, an AI compensation intelligence platform, raised $35 million in Series B funding led by Jump Capital, with participation from Crosslink Capital, Storm Ventures, Permanent Capital, HR Tech Investments, and PagsGroup.

• Fiddler AI, an AI observability and security platform, raised $30 million in Series C funding led by RPS Ventures, with participation from Lightspeed Venture Partners, Lux Capital, Insight Partners, Capgemini Ventures, Dallas VC, Dentsu Ventures, Mozilla Ventures, LG Technology Ventures, Benhamou Global Ventures, and LDV Partners.

• Adaptive6, a cloud cost optimization platform, raised $28 million in Series A funding led by U.S. Venture Partners, with participation from New Era Capital Partners, Forgepoint Capital, Pitango VC, and Vertex Ventures.

• Northslope, a developer of AI applications for the Palantir operating system, raised $22 million in Series A funding co-led by Friends & Family Capital and Goldcrest Capital.

• Visitt, an AI commercial real estate operations platform, raised $22 million in Series B funding led by Susquehanna Growth Equity, with participation from Vertex Ventures Israel, Anfield, and Sarona Ventures.

• Tradespace, an AI intellectual property management platform, raised $15 million in Series A funding led by Atlantic Vantage Point, with participation from Eniac Ventures, Amplo VC, and Scrum Ventures.

• Mesh Security, a cybersecurity mesh architecture platform, raised $12 million in Series A funding led by Lobby Capital, with participation from S Ventures and BrightPixel Capital.

• Datatruck, a Chicago-based AI operating system for long-haul trucking, raised $12 million in Series A funding led by Avenue Growth Partners.

Fintech

• Zero Hash, a crypto infrastructure platform for stablecoins and asset tokenization, is in talks to raise $250 million in new funding at a $1.5 billion valuation after ending acquisition discussions with Mastercard.

• Snout, a pet preventive care financing platform, raised $110 million in new funding, including a $10 million Series A led by Footwork and a $100 million debt facility from Clear Haven Capital Management, with participation from Pear VC, Bread and Butter Ventures, Restive Ventures, and Griffon Partners.

• Juspay, a payment infrastructure provider for enterprises and banks, raised $50 million in Series D follow-on funding at a $1.2 billion valuation led by WestBridge Capital, with participation from Avendus Capital.

• Raylo, an electronics subscription infrastructure provider, raised £30 million in Series B equity and debt funding at a £150 million post-money valuation led by Citibank, with participation from NatWest.

• Slice, an AI equity compliance and management platform for multinationals, raised $25 million in Series A funding led by Insight Partners, with participation from TLV Partners, R-Squared Ventures, and Jibe Ventures.

• Mine, a personal finance startup for young adults, raised $14 million in Series A funding led by 359 Capital, with participation from Kleiner Perkins, FJ Labs, Y Combinator, and U.S. News & World Report.

• Jelou, a developer of AI agents for financial operations in messaging apps, raised $10 million in Series A funding led by Wellington Access Ventures, with participation from Krealo and Collide Capital.

Consumer & Media

• Property Finder, a UAE real estate portal, raised $170 million in new funding led by Mubadala Investment Company, with participation from BECO Capital.

• Phia, an AI shopping agent platform, raised $35 million in Series A funding at a $185 million valuation led by Notable Capital, with participation from Khosla Ventures and Kleiner Perkins.

• Pixellot, an AI-automated sports production and streaming platform for youth and amateur markets, raised $35 million in new funding led by PSG Equity, comprising $15 million in equity and $20 million in venture debt.

Healthcare

• Tandem, a healthcare AI platform automating prescription workflows, raised $100 million in Series B funding at a $1 billion valuation led by Accel, with participation from General Catalyst.

• Gyde, an Austin, Texas-based AI health insurance brokerage, raised $60 million in new funding led by Lightspeed, with participation from Optum Ventures, Crystal Venture Partners, Virtue, and MVP Ventures.

• TRex Bio, a clinical-stage biotech developing tissue Treg-based medicines, raised $50 million in Series B extension funding from Janus Henderson Investors, Balyasny Asset Management, Affinity Asset Advisors, Alexandria Venture Investments, Avego BioScience Capital, Delos Capital, Eli Lilly, JJDC, Pfizer Ventures, Polaris Partners, and SV Health Investors.

• Recare, a Berlin-based hospital discharge and care coordination platform, raised €37 million in Series B funding led by DNV, with participation from CIBC Innovation Banking.

• Evaro, an NHS-licensed digital health platform, raised $25 million in Series A funding led by AlbionVC, with participation from Exceptional Ventures, Simplyhealth Ventures, Cornerstone VC, and BBI.

• Antheia, a pharmaceutical ingredient biosynthesis company, raised $24 million in Series C funding co-led by ATHOS KG and America's Frontier Fund, with participation from Global Health Investment Corporation and EDBI.

• Climatic, a respiratory wellness startup, raised $10 million in seed funding led by Lerer Hippeau, with participation from BBGV, Brand Foundry Ventures, Cade Ventures, Good Friends, and Space Station.

Industrials, Greentech, & Other

• DeepWay, a Chinese developer of autonomous electric heavy-duty trucks, raised around $173 million in Pre-IPO funding led by Puhua Capital, with participation from ABC Impact, Sunwoda Electronic Co, Qianhai Haotian, Hantang Real Estate, Linyi Guoke, Changxing Chuangqiang Fund, Shandong Guokong Capital, Lenovo Capital, Greater Bay Area Fund, Guangyue Investment, and Hongshan Fund.

• Standard Nuclear, a reactor-agnostic TRISO nuclear fuel producer, raised $140 million in Series A funding led by Decisive Point, with participation from Chevron Technology Ventures, StepStone Group, XTX Ventures, Welara, Fundomo, Andreessen Horowitz, Washington Harbour Partners, and Crucible Capital.

• Vention, a Montreal-based AI industrial automation platform, raised $110 million in Series D funding led by Investissement Québec, with participation from Desjardins Capital, Fidelity Investments Canada, and NVentures.

• Terra Energy, a residential solar subscription provider, raised $105 million in new debt and equity funding from ARC PE, Azora Capital, Breakwall Capital, Banesco, and First Horizon Bank.

• Northwood Space, a satellite ground station and backhaul infrastructure developer, raised $100 million in Series B funding co-led by Washington Harbour Partners and Andreessen Horowitz, with participation from Alpine Space Ventures, Founders Fund, StepStone Group, Balerion Space Ventures, Fulcrum, Pax, and 137 Ventures.

• Gigablue, a marine carbon removal developer, raised $20 million in the first close of its Series A funding led by Planet Ocean Capital.

• GlassPoint, a solar steam developer for industrial decarbonization, raised $20 million in Series A extension funding led by New Investment Solutions, with participation from MIG Capital.

FUNDRAISING

• Leonard Green & Partners raised over $3.6 billion for Sage Equity Investors, its inaugural fund focused on single-asset continuation funds sponsored by third-party managers.

• Equality Asset Management raised $575 million for its second fund focused on growth-stage software and technology companies.

• Obvious Ventures, the venture firm co-founded by Evan Williams, raised $360 million for its fifth fund focused on planetary, human, and economic health.

• Voyager Ventures raised $275 million for its second fund focused on early-stage investments in energy, industrials, and climate technology across North America and Europe.

• Daphni raised €260 million for its Blue fund focused on early-stage, science-driven deeptech startups across Europe.

• Basis Set Ventures raised $250 million for its fourth fund focused on early-stage AI and automation.

• Bertelsmann Investments launched a $200 million venture fund, Bertelsmann Healthcare Investments, focused on health tech in the U.S. and Europe.

• b2venture, a Swiss venture capital firm, raised €150 million for its fifth fund focused on early-stage European technology companies.

• Epidarex Capital raised $145 million for the first close of its fourth fund focused on early-stage life sciences and medical devices in the UK and US.

• Hetz Ventures $140 million for its fourth fund focused on early-stage Israeli startups in cybersecurity, data platforms, and AI infrastructure.

• Boyne Capital raised a single-asset continuation fund anchored by New 2ND Capital to support its continued ownership of Pilot Energy, a San Diego-based energy advisory and management platform.

PARTNERSHIPS

Interested in partnering with Transacted? If you’re a financial services firm looking to connect with an engaged audience, please reach out.