- Transacted

- Posts

- Fabricated collateral

Fabricated collateral

HPS uncovers borrower fraud shortly after BlackRock acquisition

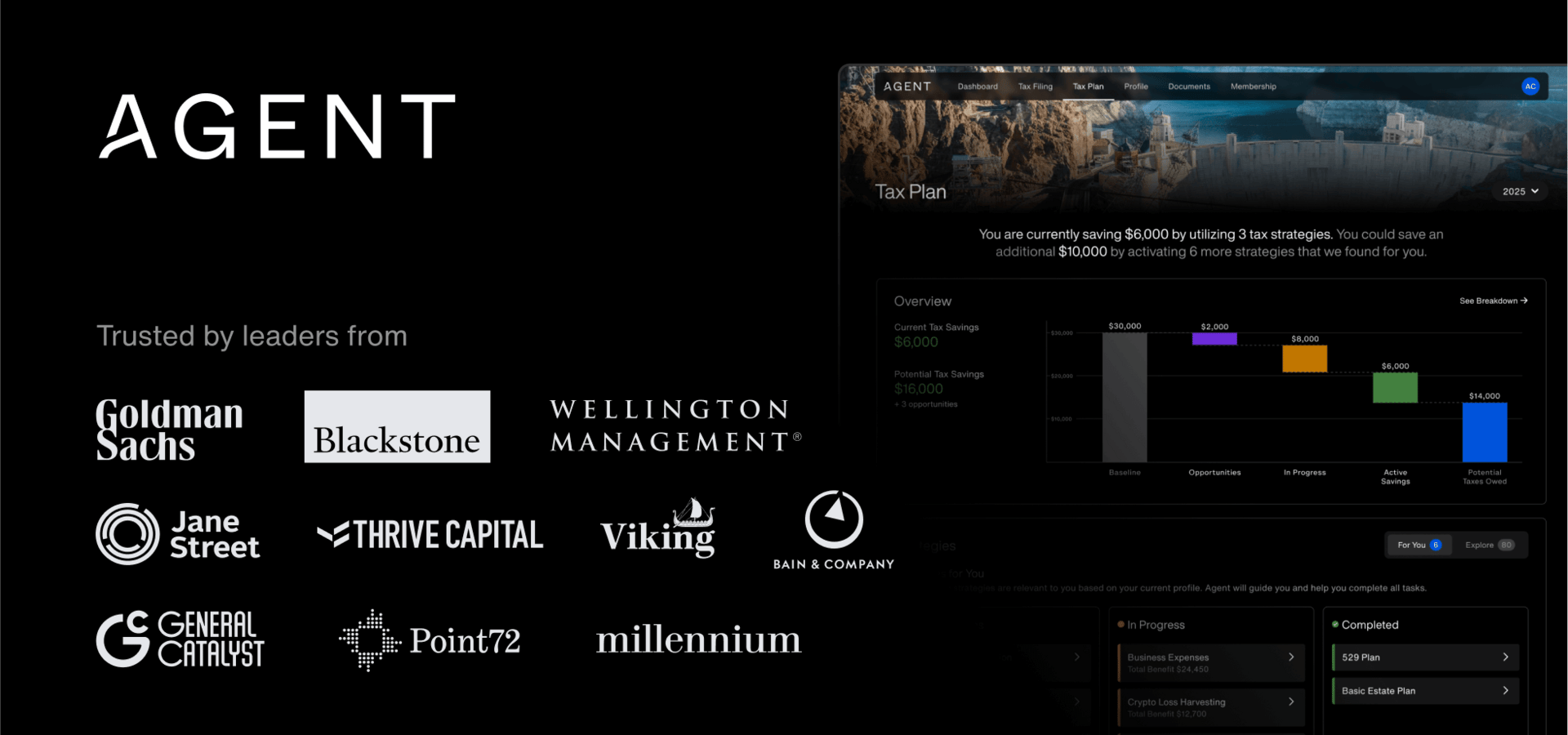

PRESENTED BY AGENT TAX

Transacted

November 6, 2025

Happy Thursday. Here’s what we’ve got today…

A look at alleged trade receivables fraud uncovered by HPS Investment Partners

Plus, Izzy Englander sells a minority stake in Millennium Management

Tax is your biggest expense. Stop treating it like an afterthought.

Enter Agent Tax, the modern tax strategy firm purpose-built for investment professionals.

Your dedicated expert tax advisor (yes, human) will leverage technology to proactively plan, prepare, and optimize your taxes.

On average, Agent clients have historically saved more than $80k through smarter, data-driven tax planning.

No more hourly billing. No more surprises. No more missed opportunities. Just smarter, proactive tax strategy.

Fabricated collateral:

Weeks after BlackRock closed its $12 billion acquisition of HPS Investment Partners, the firm became aware of alleged asset-backed finance fraud tied to borrower Carriox Capital and its owner Bankim Brahmbhatt.

HPS and other lenders, including BNP Paribas, say that Brahmbhatt owes them more than $500 million.

In August 2024, lenders extended two facilities to companies affiliated with Brahmbhatt ($430 million in Facility A and $100 million in Facility B), but now say that many of the customer invoices pledged by Carriox as collateral never actually existed.

A complaint filed in Delaware Chancery Court against Brahmbhatt describes a series of fake web domains, fake contracts, forged signatures, and interest serviced with proceeds of new loans.

One complaint describes an “extraordinarily brazen and widespread fraud.”

At the time of the facilities' initial funding, HPS had worked with Deloitte to conduct random customer checks to verify the collateral and had engaged accounting firm CBIZ to conduct annual asset checks.

Despite those checks, concerns over the veracity of Brahmbhatt's pledged invoices surfaced roughly twelve months later.

In July, an HPS employee noticed irregularities with certain email addresses tied to Carriox customers, reported the Wall Street Journal.

Lenders allege that the emails, provided by Carriox as proof of the invoiced amounts, had been sent by fake addresses that were made to appear like legitimate telecom companies.

When HPS approached Brahmbhatt with their findings, he told the firm there was nothing to worry about. He stopped answering their phone calls shortly after.

Later that month, an HPS associate visited Brahmbhatt's offices in Garden City, NY, and found them empty.

Working with CBIZ and Quinn Emanuel, the lender group launched a deeper investigation into the pledged invoices. Findings matched the initial pattern of fake addresses, and purported customers contacted by the group were often unaware of the supposed dealings with Brahmbhatt's companies referenced in the invoices.

“Brahmbhatt created an elaborate balance sheet of assets that existed only on paper,” allege lenders. According to filings, lenders also believe Brahmbhatt transferred assets that were supposed to have been pledged as collateral to offshore accounts in India and Mauritius.

HPS wrote down roughly $150 million tied to the loans, which were held within its Asset Value strategy. The exposure, however, is small relative to the firm’s nearly $180 billion of assets under management.

Carriox Capital, which offered financing solutions and invoice factoring to carriers and telecom infrastructure developers, first borrowed from HPS in 2020 and expanded the relationship in 2021. Those borrowings were believed to be secured by receivables from a host of reputable customers, including T-Mobile, Telstra, and Telecom Italia.

In a 2024 podcast, Brahmbhatt said: “I decided, why should I run my business with the operator’s money? Instead, let me go in the market and raise funds. So that was another turning point for me. So we started financing the working capital of the partners.”

Brahmbhatt, who had agreed to lenders' request that he personally guarantee the loans, filed for personal bankruptcy on August 12th, the same day that several of his corporate entities entered Chapter 11.

Speaking through an attorney, he disputed the fraud allegations.

The case is the latest blow-up in an asset-backed finance market that's been dealing with the fallout of similar issues at automotive businesses Tricolor (accused of using fabricated car loans as collateral) and First Brands (collapsed under a pile of off-balance-sheet debt)—both of which are currently in the middle of messy bankruptcy proceedings.

DEALS, DEALS, DEALS

• Bain Capital is in exclusive talks to acquire the Australian wealth management unit of Perpetual (ASX: PPT) for around $14 billion.

• Apollo (NYSE: APO) invested $6.5 billion for a 50% stake in Ørsted’s Hornsea 3, the world’s largest offshore wind project in the UK.

• KKR and Singtel are in advanced talks to acquire more than 80% of ST Telemedia Global Data Centres, a Singapore data centre firm, adding to their existing combined stake of 18%, for more than $3.9 billion.

• Aquarian Capital agreed to acquire Brighthouse Financial (Nasdaq: BHF), a U.S. life insurance and annuity provider, for $4.1 billion.

• TPG, through its Rise Climate fund, agreed to acquire a 70% stake in Kinetic, the largest bus operator in Australasia, from Canadian pension OPTrust at an A$4 billion valuation.

• Aeromexico, an Apollo-backed Mexican airline, raised $222.8 million in its U.S. IPO, valuing the company at $2.77 billion.

• Papa John's (Nasdaq: PZZA) saw Apollo Global Management withdraw its $2.1 billion, $64-per-share takeover offer amid softening consumer demand.

• PennAero, a Tinicum portfolio company, and Blackstone agreed to acquire TriMas Aerospace, a provider of highly engineered fasteners and precision-machined components for aerospace and defense industries, for $1.45 billion from TriMas Corporation (NYSE: TRS).

• CBRE Group Inc. (NYSE:CBRE) acquired Pearce Services, a provider of advanced technical services for digital and power infrastructure, from New Mountain Capital for $1.2 billion in cash plus a potential earn-out of up to $115 million.

• Izzy Englander sold a 15 percent stake in hedge fund Millennium Management to an investor group for $2 billion, valuing the firm at approximately $14 billion.

• SM Energy (NYSE: SM) agreed to merge with Civitas Resources (NYSE: CIVI), an oil and gas producer, in an all-stock deal valued at $12.8 billion, including debt.

• Eaton (NYSE: ETN) agreed to acquire the Boyd Thermal business of Boyd Corp. from Goldman Sachs Asset Management for $9.5 billion.

• Orange (Euronext Paris: ORA) agreed to acquire the remaining 50% stake it didn't already hold in its Spanish joint venture MasOrange for €4.25 billion from KKR, Cinven, and Providence.

• LLOG Exploration Offshore, one of the largest privately held US Gulf oil and gas producers, is exploring a potential sale that could be valued at more than $3 billion including debt, per Reuters.

• BP (NYSE: BP) agreed to sell minority stakes in its U.S. onshore midstream assets in the Permian and Eagle Ford basins to Sixth Street for $1.5 billion.

• Intuitive Machines (Nasdaq: LUNR) agreed to acquire Lanteris Space Systems, a Palo Alto, California-based spacecraft manufacturer formerly known as Maxar Space Systems, for $800 million from Advent International.

• Denny's Corporation (Nasdaq: DENN) agreed to be taken private by TriArtisan Capital Advisors, Treville Capital Group, and Yadav Enterprises in a $620 million transaction, including debt.

• Philadelphia Insurance Companies, a unit of Tokio Marine Holdings, acquired the Collector Vehicle Division from Ignyte Insurance, a Carlyle portfolio company, for $615 million.

• TPG agreed to acquire PTC (Nasdaq: PTC)'s Kepware and ThingWorx industrial connectivity and IoT businesses for up to $725 million.

• Charles Schwab (NYSE: SCHW) agreed to acquire Forge Global Holdings (NYSE: FRGE), a private market platform and trading marketplace, for approximately $660 million.

• Bain Capital acquired Sizzling Platter, a restaurant franchisee platform, from CapitalSpring.

• Royalty Pharma (Nasdaq: RPRX) acquired a 1% royalty interest in Alnylam (Nasdaq: ALNY)’s AMVUTTRA, an FDA-approved RNAi therapeutic for ATTR amyloidosis, from Blackstone Life Sciences for $310 million.

• Monarch Collective acquired a 38% stake in FC Viktoria Berlin, a German women's second-tier soccer club.

• Evive Brands, a portfolio company of The Riverside Company, acquired Pacific Lawn Sprinklers, a franchised provider of irrigation and outdoor services in 10 states.

• JT Thorpe Group, Inc., backed by H.I.G. Capital, acquired ThorCan, a Burlington, Ontario-based provider of specialized refractory services.

• Eleda, a Swedish infrastructure projects and services provider backed by Bain Capital, has selected DNB Carnegie and Morgan Stanley to advise on a potential Stockholm IPO as early as next year, per Bloomberg.

• L Squared Capital Partners invested in Ergo, a New York City-based technology-enabled geopolitical and strategic intelligence firm.

• JLL Partners acquired Parks Medical Electronics, a manufacturer of medical Doppler ultrasound and vascular diagnostic systems, which will be merged with its portfolio company Vascular Technology Incorporated.

• Clearstone Capital, a Canadian private equity firm, acquired Brüst Beverages, an RTD protein coffee brand.

• Wind Point Partners acquired Buske, a contract warehousing and supply chain services firm serving the food, beverage, and CPG sectors.

• Cerealto, backed by Davidson Kempner Capital Management and Afendis Capital Management, made a majority investment in Fresca Foods, a Louisville, Colorado-based co-manufacturer of natural and organic snacks.

• Valence Surface Technologies, a portfolio company of ATL Partners and British Columbia Investment Management Corporation, acquired Foresight Finishing, a provider of precious metal surface treatment for aerospace and defense products.

• Five Arrows and Deutsche Beteiligungs AG (DBAG) agreed to acquire Totalmobile, a provider of field service management software, from Bowmark Capital.

• Brown & Root Industrial Services, backed by One Equity Partners and KBR, agreed to acquire Specialty Welding and Turnarounds, a Gonzales, Louisiana-based provider of turnaround, cooling tower, and industrial catalyst services.

• Rubix, an industrial MRO products provider backed by Advent International, acquired ERIKS UK & Ireland, an industrial distributor.

• Tyree & D’Angelo Partners closed a single-asset continuation fund for Western Veterinary Partners, led by HarbourVest.

VENTURE & EARLY-STAGE

Tech, Vertical SaaS, & Misc. Enterprise

• Armis, a cyber exposure management company, raised $435 million in pre-IPO funding, led by Goldman Sachs Alternatives' Growth Equity fund, with participation from CapitalG and Evolution Equity Partners.

• Beacon Software, an AI holding company, raised $250 million in Series B funding co-led by General Catalyst, Lightspeed Venture Partners, and D1 Capital, with participation from BDT & MST Partners and Sator Grove.

• MoEngage, a customer engagement platform, raised $100 million in Series F funding co-led by Goldman Sachs Alternatives and A91 Partners.

• Reevo, an AI GTM platform, raised $80 million in combined seed and Series A funding co-led by Khosla Ventures and Kleiner Perkins, with participation from Zhu Ventures.

• Inception, a Palo Alto-based AI startup developing large language models for code and text, raised $50 million in seed funding led by Menlo Ventures, with participation from Mayfield, M12, Snowflake Ventures, Databricks Investment, Innovation Endeavors, and NVentures.

• DeepJudge, a Swiss legal tech AI company, raised $41.2 million in Series A funding led by Felicis, with participation from Coatue.

• Daylight, an Israeli AI-powered Managed Detection and Response (MDR) platform, raised $33 million in Series A funding, led by Craft Ventures, with participation from Bain Capital Ventures and Maple VC.

• Procurement Sciences, an AI software company for government contract management, raised $30 million in Series B funding, led by Catalyst Investors, with participation from Battery Ventures, Tower Research Ventures, K-Street Capital, Blu Ventures, Bosch Ventures, and Citi.

• DualBird, an AI data processing infrastructure company, raised $25 million in combined Seed and Series A funding, led by Lightspeed Venture Partners, with participation from Bessemer Venture Partners, Angular Ventures, and Uncork Capital.

• Truffle Security, an open-source security software company for credential and non-human identity security, raised $25 million in Series B funding co-led by Intel Capital and a16z, with participation from Abstract and Lytical Ventures.

• Teleskope, an automated data security platform, raised $25 million in Series A funding led by M13, with participation from Primary Venture Partners and Lerer Hippeau.

• Octonomy, a German-founded AI company developing agentic systems for enterprise support and service, raised $20 million in Seed funding led by Macquarie Capital Venture Capital, with participation from Capnamic, NRW.Bank, and TechVision Fund.

• RAAAM Memory Technologies, an Israeli semiconductor startup developing next-generation on-chip memory, raised $17.5 million in Series A funding led by NXP Semiconductors.

• Parable, an enterprise operations intelligence platform, raised $16.5 million in Seed funding led by HOF Capital, with participation from Story Ventures and InMotion Ventures.

• Flint, an AI tutor platform for K-12 schools, raised $15 million in Series A funding from Basis Set Ventures.

• Malanta, a predictive cybersecurity startup, raised $10 million in seed funding led by Cardumen Capital, with participation from The Group Ventures.

• Tsuga, a Paris-based AI-native observability platform, raised $10 million in Seed funding, led by General Catalyst, with participation from Singular.

Fintech

• Ripple, a blockchain payments firm, raised $500 million in strategic investment co-led by Fortress Investment Group and Citadel Securities, with participation from Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

• Fintary, an AI platform automating commission processing and financial operations for insurance companies, raised $10 million in Series A funding led by Infinity Ventures, with participation from Sierra Ventures.

Consumer & Media

• The Icon League, a Berlin-based five-a-side soccer league, raised €15 million in Series A funding, led by HV Capital.

Healthcare

• Synchron, a non-surgical BCI company, raised $200 million in Series D funding led by Double Point Ventures, with participation from ARCH Ventures, Khosla Ventures, Bezos Expeditions, NTI, METIS, the Australian National Reconstruction Fund, T.Rx Capital, Qatar Investment Authority, and K5.

• Braveheart Bio, a biotechnology company developing therapeutics for hypertrophic cardiomyopathy (HCM), raised $185 million in Series A funding, co-led by a16z Bio + Health, Forbion, OrbiMed, Enavate Sciences, and Frazier Life Sciences.

• Tala Health, a healthcare company integrating AI agents with clinicians, raised $100 million in seed funding led by Sofreh Capital.

• Azalea Therapeutics, a biotech developing in vivo genomic and CAR-T therapies, raised $82 million in seed and Series A financing led by Third Rock Ventures, with participation from RA Capital Management, Yosemite, and Sozo Ventures.

• Affect Therapeutics, a digital mental health and addiction company, raised $26 million in Series B funding led by Allumia Ventures.

• Indomo, a therapeutics company for at-home prescription dermatology, raised $25 million in new funding, co-led by Atomic, Foresite Capital, and Polaris Partners, with participation from Atomic14 Ventures, Evolution VC Partners, and FORM Life Ventures.

• Popai Health, a patient conversation intelligence company, raised $11 million in seed funding co-led by Team8 and NEA.

• LambdaVision, a biotech developing protein-based artificial retinas, raised $7 million in Seed funding co-led by Seven Seven Six and Aurelia Foundry Fund, with participation from Seraphim Space.

• Helex, a non-viral gene therapy company for genetic kidney diseases, raised $3.5 million in Seed funding led by pi Ventures, with participation from Bluehill Capital and SOSV.

Industrials, Greentech, & Other

• Infravision, an aerial robotics company for power grid construction and maintenance, raised $91 million in Series B funding led by GIC, with participation from Activate Capital, Hitachi Ventures, and Energy Impact Partners.

• Evotrex, a power-generating RV trailer company, raised $16 million in Pre-A funding led by Xstar Capital.

• Hullbot, a developer of autonomous hull-cleaning robots, raised $16 million in Series A funding led by Regeneration.VC, with participation from Climate Tech Partners, Katapult Ocean, Folklore Ventures, Trinity Ventures, Rypples, NewSouth Innovations, Bandera Capital, Artesian, and Impact Ventures/Ocean Impact Collective.

• Poseidon Aerospace, a company developing unmanned cargo aircraft, raised $11 million in seed funding led by Tamarack Global, with participation from Draper Associates, Starship Ventures, Drover Ventures, Cade Ventures, GoAhead Ventures, Fortitude VC, Mana Ventures, and Shor Capital.

FUNDRAISING

• Blackstone is targeting $5.6 billion for its third GP stakes fund.

• Stone Point closed an eight-asset continuation vehicle, raising $3.045 billion from investors including Ardian and AlpInvest Partners.

• Montagu raised €2 billion for a single-asset continuation vehicle to extend its hold of Wireless Logic, an IoT platform provider, with participation from TPG GP Solutions, CVC Secondary Partners, and Partners Group.

• Aspirity Partners raised €875 million for its debut fund focused on growth-stage financial and enterprise technology across Europe.

• Polaris Partners raised $439 million for its third growth fund.

PARTNERSHIPS

Interested in partnering with Transacted? If you’re a financial services firm looking to connect with an engaged audience, please reach out.