- Transacted

- Posts

- Evergreen questions

Evergreen questions

Troubled assets bought by a new Brookfield fund

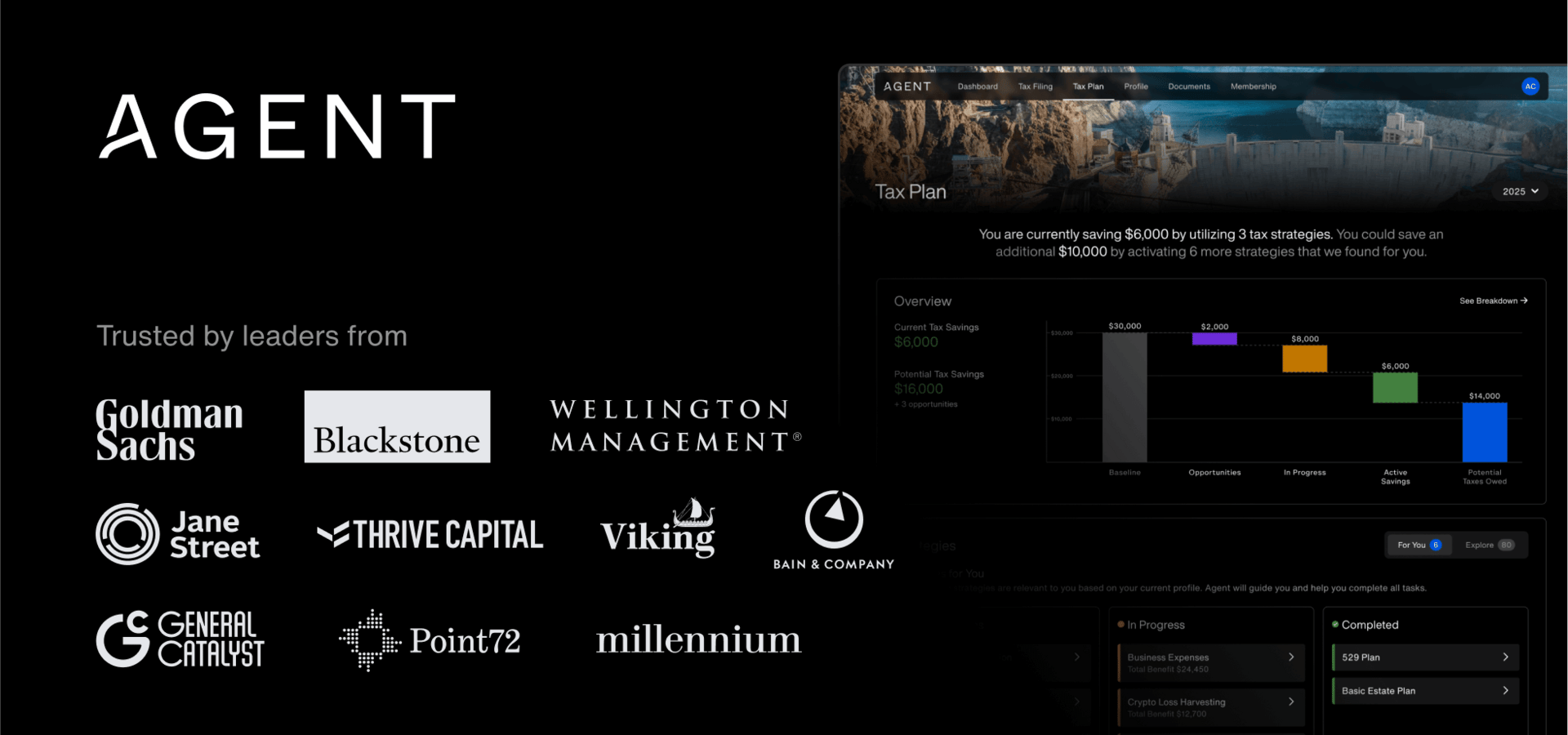

PRESENTED BY AGENT TAX

Transacted

November 13, 2025

Happy Thursday. Here’s what we’ve got today…

A look at potential trouble in Brookfield’s recently launched evergreen fund

Plus, Stonepeak nears a deal for Castrol lubricants

Tax is your biggest expense. Stop treating it like an afterthought.

Enter Agent Tax, the modern tax strategy firm purpose-built for investment professionals.

Your dedicated expert tax advisor (yes, human) will leverage technology to proactively plan, prepare, and optimize your taxes.

On average, Agent clients have historically saved more than $80k through smarter, data-driven tax planning.

No more hourly billing. No more surprises. No more missed opportunities. Just smarter, proactive tax strategy.

Evergreen questions:

Brookfield’s new evergreen private equity fund is facing early scrutiny as two of its holdings risk falling into distressed territory, raising questions about related‑party dealings, valuation, and liquidity in a vehicle marketed to private wealth customers.

The fund, launched in October, acquired minority stakes in CDK, BrandSafway, and DexKo Global from Brookfield Business Partners, a listed fund also managed by Brookfield, which remains invested in all three.

Within weeks of the fund’s launch, lenders to the three portfolio companies have expressed concern over the financial health of the assets.

Bloomberg reports that lenders to CDK and BrandSafway have held discussions with their respective legal teams to assess options. DexKo, an auto parts manufacturer, is fielding questions around its accounting and financing practices following the collapse of auto parts retailer First Brands Group last month.

Market pricing for CDK and BrandSafeway debt is now hovering near distressed territory.

CDK’s roughly $4 billion loan traded at about 82 cents on the dollar on Thursday and has not traded above 90 cents since March. The company has been dealing with the aftermath of a cyberattack last year, “which forced it to shut down all its systems.”

BrandSafway’s loan traded as low as 84.25 cents in August, and Moody’s Ratings cut its credit grade to Caa1 in June, citing “weak operating results, negative free cash flow, and weak credit metrics.”

DexKo’s debt has held near 98 cents, though Moody’s in June flagged very high financial leverage and volume declines in North America.

As debt holders lose confidence in the companies' financial strength, the value of the equity held by Brookfield's new evergreen fund could be in jeopardy if the businesses fail to recover.

The evergreen fund is positioned as an opportunity for individual investors to add exposure to private markets. The vehicle invests alongside other Brookfield funds and can acquire interests from them, while also offering lower capital requirements and periodic liquidity.

The portfolio's situation has led to renewed focus on the related-party purchase of the stakes from one Brookfield-managed fund to another. For those already skeptical of opening private markets access to individual investors, the current optics hit on a primary criticism: that fund managers might shift underperforming assets from primary funds onto smaller investors.

The fund's disclosures, however, do explicitly warn prospective investors that it intends to invest in distressed assets, including those "having substantial financial needs or negative net worth, facing special competitive or product obsolescence problems, or that are involved in bankruptcy or reorganization proceedings."

Warnings also include an overview of certain situations in which investors’ newfound access to the wider Brookfield platform can expose them to "double fees" — another common point of contention for those critical of retail-oriented private markets offerings.

When investing alongside other Brookfield funds, explain the disclosures, investors will pay management fees to both the evergreen fund and the underlying fund. "Because of the fees and expenses payable by the Fund pursuant to such Investments, its returns on such Investments will be lower than the returns to a direct investor in the Target Funds,” warns the filing.

DEALS, DEALS, DEALS

• Thoma Bravo received stockholder approval for its $12.3 billion acquisition of Dayforce (NYSE:DAY), a human capital management company.

• Parker Hannifin Corporation (NYSE: PH) agreed to acquire Filtration Group Corporation, a filtration and separation science company, for $9.25 billion from Madison Industries.

• BP (NYSE: BP) is in active talks to sell its Castrol lubricants unit to Stonepeak for around $8 billion, after both Stonepeak and One Rock submitted bids in September, per Reuters.

• Markerstudy, a UK insurer backed by Pollen Street, is preparing for an initial public offering that could value the business at over £3 billion.

• HongShan Capital Group is in advanced talks to acquire Golden Goose, an Italian luxury sneaker maker, from Permira at a valuation of over 2.5 billion euros, per Reuters.

• Macquarie Asset Management, along with UniSuper and Partners Capital, agreed to acquire a majority stake in Potters Industries, an infrastructure services and materials business, for around $1.1 billion from TJC.

• Goldman Sachs agreed to acquire a majority stake in Excel Sports Management, a talent agency, for around $1 billion from Shamrock Capital.

• Clearlake Capital Group agreed to acquire Pathway Capital Management, an Irvine, California-based global provider of private market solutions, for nearly $1 billion.

• ABN AMRO (AMS: ABN) agreed to acquire NIBC Bank, a commercial bank, for around €960 million from Blackstone.

• SCG, a British telecom and cloud services provider, hired Houlihan Lokey to advise on a potential sale that could value the company at £800 million, per Bloomberg.

• Nexture, a portfolio company of Investindustrial, agreed to acquire Frulact, a natural ingredient solutions platform for the food and beverage industry, from Ardian for around €600 million.

• Coalesce Capital agreed to acquire a majority stake in DecisionHR, a St. Petersburg, Florida-based national provider of HR outsourcing solutions, in a $450 million deal.

• C3 AI (NYSE: AI), an enterprise artificial intelligence software provider, is exploring a potential sale, among other options, after founder Thomas Siebel stepped down as CEO, per Reuters.

• Renovus Capital Partners acquired K2 Services, which concurrently acquired Epiq Global Business Transformation Solutions and Forrest Solutions.

• Harbor Global, a portfolio company of BayPine, acquired Encoretech, an NYC-based legal tech training services firm.

• Activated Insights, backed by Cressey & Company, acquired CareAcademy, a Boston-based caregiver education and compliance automation provider.

• Turnspire Capital Partners acquired LifeLine Foods, a food company, and ICM Biofuels, a biofuels company, combining their operations to form The LifeLine Group.

• Sequel Ortho, a portfolio company of InTandem Capital Partners, acquired Fox Valley Orthopedics, a Geneva, Illinois-based orthopedics group.

• Permira acquired a majority stake in The Key Group, a British education software provider, from CBPE.

• Clayton, Dubilier & Rice is exploring a potential acquisition of Sealed Air (NYSE: SEE), the packaging company known for Bubble Wrap, per Bloomberg.

• Clearwater Analytics Holdings (NYSE: CWAN), a provider of investment and accounting software, is exploring a potential sale after receiving takeover interest, per Bloomberg.

• H.I.G. Capital invested in Rely Home, a nationwide home warranty provider.

• International Wire Group, a portfolio company of Olympus Partners, acquired Special Corde S.r.l., an Italian supplier of specialty conductors.

• Investcorp acquired Kanawha Scales & Systems, a provider of industrial weighing systems and automated control services, from American Equipment Holdings, a portfolio company of Rotunda Capital Partners.

• Quadrum Global is exploring the sale of Arlo Hotels, a boutique lodging chain with outposts in New York, Miami, and Washington, per Bloomberg.

• BILL (NYSE: BILL), a payments software provider, is exploring a sale amid activist investor pressure from Starboard Value, per Bloomberg.

• Diversis Capital acquired and combined Genesis Automation Healthcare, Kermit, and Meperia, three technology companies focused on hospital supply chain management, to create an end-to-end healthcare supply chain and inventory management platform.

• Francisco Partners agreed to acquire a majority stake in OEConnection, a digital platform supporting the automotive aftersales ecosystem, from Genstar Capital, which will retain a minority stake alongside Ford and General Motors.

VENTURE & EARLY-STAGE

Tech, Vertical SaaS, & Misc. Enterprise

• Anysphere, an AI coding startup, raised $2.3 billion in Series D funding at a $29.3 billion valuation co-led by Accel and Coatue, with participation from Thrive Capital, DST Global, and Andreessen Horowitz.

• Clio, a legal AI company, raised $500 million in Series G funding at a $5 billion valuation led by New Enterprise Associates, with participation from TCV, Goldman Sachs Asset Management, Sixth Street Growth, and JMI Equity.

• d-Matrix, an AI chip startup, raised $275 million in Series C funding at a $2 billion valuation co-led by Bullhound Capital, Triatomic Capital, and Temasek, with participation from Qatar Investment Authority, EDBI, M12, Nautilus Venture Partners, Industry Ventures, and Mirae Asset.

• Alembic Technologies, an AI marketing firm, raised $145 million in Series B funding co-led by Prysm Capital and Accenture, with participation from Liquid 2 Ventures, NextEquity, and WndrCo.

• Parallel Web Systems, an AI web search infrastructure startup for AI agents, raised $100 million in Series A funding, co-led by Kleiner Perkins and Index Ventures, with participation from Spark Capital and Khosla Ventures.

• Wonderful, an Israeli AI agent startup, raised $100 million in Series A funding led by Index Ventures, with participation from Insight Partners, IVP, Bessemer Venture Partners, and Vine Ventures.

• Sweet Security, a cloud and AI security startup, raised $75 million in Series B funding, led by Evolution Equity Partners, with participation from Munich Re Ventures, Glilot Capital Partners, and Key1 Capital.

• Scribe, a workflow AI platform, raised $75 million in Series C funding at a $1.3 billion post-money valuation led by StepStone, with participation from Amplify Partners, Redpoint Ventures, Tiger Global, Morado Ventures, and New York Life Ventures.

• Tenzai, an AI-native cybersecurity company for autonomous penetration testing, raised $75 million in Seed funding co-led by Greylock Partners, Battery Ventures, and Lux Capital, with participation from Swish Ventures.

• Majestic Labs, a developer of AI servers, raised $71 million in Series A funding led by Bow Wave Capital, with participation from Lux Capital, SBI, Upfront Ventures, Grove Ventures, Hetz Ventures, QP Ventures, Aidenlair Global, and TAL Ventures.

• GC AI, an AI platform for in-house legal teams, raised $60 million in Series B funding co-led by Scale Venture Partners and Northzone, with participation from Sound Ventures, Aglaé Ventures, SilverCircle Partners, News Corp, and The Council.

• WisdomAI, an AI data analytics startup, raised $50 million in Series A funding co-led by Kleiner Perkins and NVentures, with participation from Coatue, Latitude Capital, Madrona, GTM Capital, Menlo Ventures, and U First Capital.

• BoomPop, an AI-powered platform for company events, raised $41 million in Series A funding led by Wing VC, with participation from Atomic, Acme, Four Rivers, Thayer Investment Partners, the Fund of Operators Guild, and Gaingels.

• Tavus, a developer of AI humans, raised $40 million in Series B funding, led by CRV, with participation from Scale Venture Partners, Sequoia Capital, Y Combinator, HubSpot Ventures, and Flex Capital.

• Beside, an AI voice startup developing small business intelligent assistants, raised $32 million in Series A funding led by EQT Ventures, with participation from Index Ventures and ISAI.

• Attentive.ai, an AI construction takeoff platform, raised $30.5 million in Series B funding led by Insight Partners, with participation from Vertex Ventures, Tenacity Ventures, and InfoEdge Venture Fund.

• 1mind, an AI sales startup, raised $30 million in Series A funding led by Battery Ventures, with participation from Primary Ventures, Wing Venture Capital, Harmonic Growth Partners, Operator Collective, Alumni Ventures, and Success Venture Partners.

• Agency, an AI customer success startup, raised $20 million in Series A funding, led by Menlo Ventures, with participation from Sequoia Capital, Felicis Ventures, and Snowflake Ventures.

Fintech

• Zilch, a BNPL fintech, raised $176.7 million in new funding led by KKCG, with participation from BNF Capital.

• Arrived, a fractional real estate investing platform, raised $27 million in new funding led by Neo, with participation from Forerunner Ventures, Bezos Expeditions, and Core.

• Anzen, an AI-powered platform for commercial insurance distribution, raised $16 million in Series A funding led by Madrona, with participation from Sandbox Industries, SNR, Andreessen Horowitz, Tokio Marine, and MS&AD Ventures.

Consumer & Media

• Gopuff, an instant commerce leader, raised $250 million in new funding co-led by Eldridge Industries and Valor Equity Partners, with participation from Baillie Gifford, Robinhood, and Equalis Capital.

• Skims, a shapewear brand, raised $225 million in new funding led by Goldman Sachs Alternatives, with participation from BDT & MSD Partners' affiliated funds.

• REBEL, a recommerce marketplace for open-box and overstock goods, raised $25 million in Series B funding led by MarcyPen Capital Partners.

Healthcare

• Iambic Therapeutics, an AI drug discovery platform, raised $100 million in Series B funding co-led by Ascenta Capital and Abingworth, with participation from NVIDIA, Illumina Ventures, Sequoia Capital, ARK, Regeneron Ventures, Qatar Investment Authority, Catalio Capital Management, and Coatue.

• Beacon Biosignals, a neurotechnology company developing AI-driven diagnostics and precision medicines, raised $86 million in Series B funding, co-led by Innoviva, GV, Nexus NeuroTech Ventures, S32, and Catalio Capital Management, with participation from General Catalyst and Logos.

• Gate Bioscience, a protein elimination biotech developing molecular gate medicines, raised $65 million in Series B funding, led by Forbion, with participation from Eli Lilly and Company and Versant.

• House Rx, a health tech company making specialty medications more accessible and affordable, raised $55 million in Series B equity and debt funding co-led by New Enterprise Associates and Town Hall Ventures, with participation from LRVHealth, First Round Capital, and Bessemer Venture.

• myTomorrows, a healthtech company connecting patients with pre-approval treatments, raised $29 million in growth equity funding led by Avego Healthcare Capital.

• Lumonus, a provider of AI-powered radiation oncology workflow solutions, raised A$25 million in Series B funding led by Aviron Investment Management, with participation from Oncology Ventures.

• Evidium, a healthcare AI platform for medical knowledge and clinical reasoning, raised $22 million in Series A funding, co-led by Health2047 and WGG Partners, with participation from Interwoven Ventures and Mindset Ventures.

• Modulight Biotherapeutics, an optogenetic platform for neurological disorders, raised $12.2 million in Seed funding, co-led by Jibe Ventures and LocalGlobe, with participation from Nexus Neurotech Ventures, RedSeed VC, Secret Chord Ventures, Fresh Fund, Saras Capital, SilverArc Capital, and Sha'ar Mi.

Industrials, Greentech, & Other

• CHAOS Industries, a defense technology company focused on counter-drone radar and communication systems, raised $510 million in Series D funding at a post-money valuation of $4.5 billion led by Valor Equity Partners.

• Forterra, a developer of autonomous military vehicles, raised $238 million in Series C equity and debt funding led by Moore Strategic Ventures, with participation from Salesforce Ventures, Franklin Templeton, Balyasny Asset Management, 645 Ventures, Hanwha Asset Management, 9Yards Capital, NightDragon, XYZ Venture Capital, Hedosophia, Enlightenment Capital, and Crescent Cove.

• Harbinger, an electric truck startup, raised $160 million in Series C funding co-led by FedEx, Capricorn's Technology Impact Fund, and THOR Industries.

• Teradar, a developer of terahertz vision sensors for autonomous vehicles, raised $150 million in Series B funding led by VXI Capital, with participation from Capricorn Investment Group, IBEX Investors, The Engine Ventures, and Lockheed Martin Ventures.

• Valar Atomics, an advanced nuclear reactor developer, raised $130 million in Series A funding, co-led by Snowpoint Ventures, Day One Ventures, and Dream Ventures, with participation from Balerion, Contrary, DTX, Alumni, Crosscut, TriplePoint Capital, and Riot Ventures.

• Neros, an El Segundo, CA-based supplier of FPV drones for military use, raised $75 million in Series B funding, led by Sequoia Capital, with participation from Vy Capital US and Interlagos.

• Fabric8Labs, a pioneer in ECAM 3D printing technology, raised $50 million in Series B funding, co-led by NEA and Intel Capital, with participation from Lam Capital, TDK Ventures, SE Ventures, Marunouchi Innovation Partners, and SK hynix.

FUNDRAISING

• Neuberger Berman raised $7.3 billion for its fifth private credit fund.

• Monomoy Capital Partners raised over $500 million for its third Credit Opportunities Fund.

• Vistara Growth raised $321 million for its fifth growth-stage lending fund.

• Section Partners raised a combined $189 million for Section Capital V, Section Ventures II, and a parallel co-investment vehicle.

• Backed VC raised $100 million for its third seed fund focused on European frontier tech.

PARTNERSHIPS

Interested in partnering with Transacted? If you’re a financial services firm looking to connect with an engaged audience, please reach out.