- Transacted

- Posts

- Broadly syndicated PIK

Broadly syndicated PIK

More flexibility for sponsors as banks compete with private credit

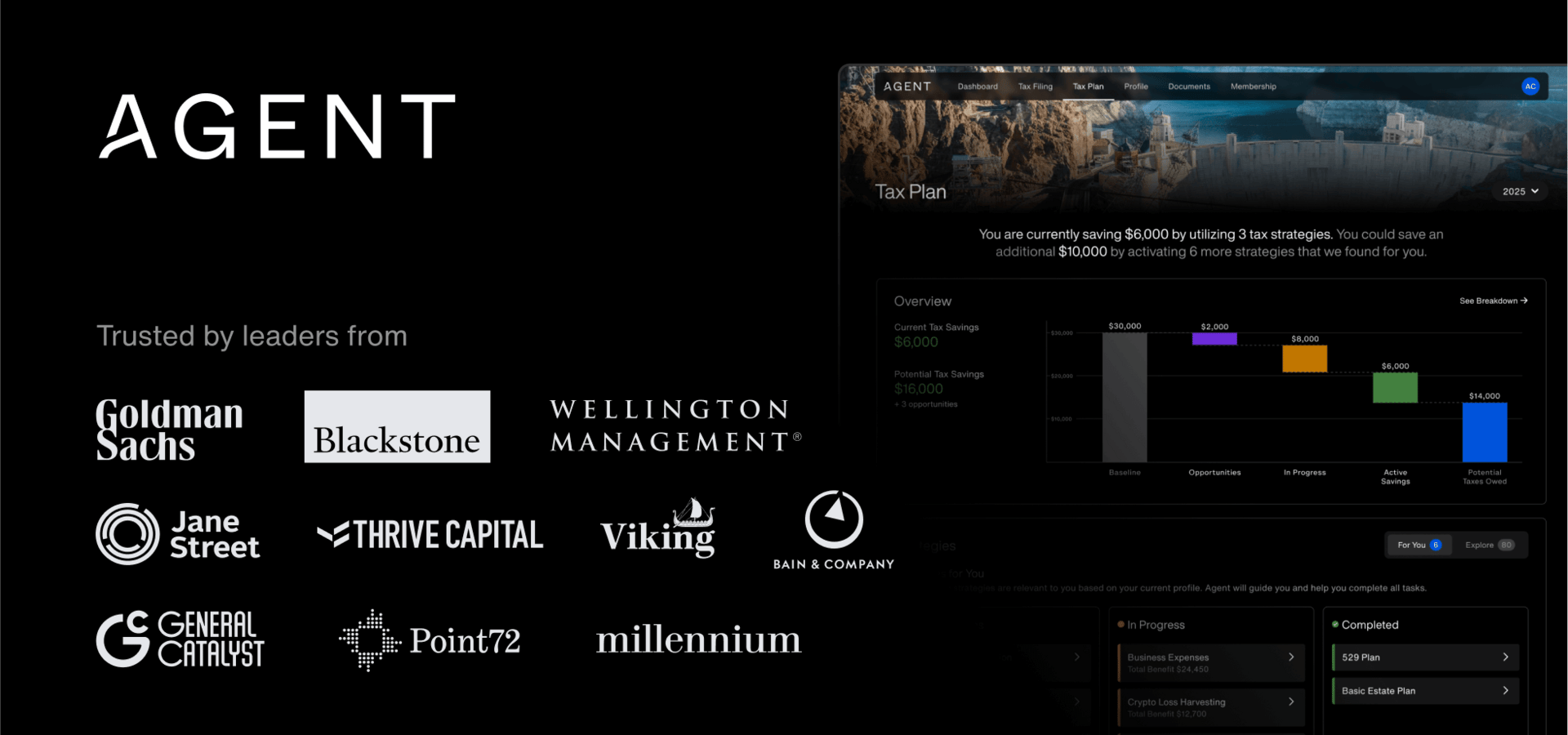

PRESENTED BY AGENT TAX

Transacted

November 11, 2025

Happy Tuesday. Here’s what we’ve got today…

A look at PIK features in broadly syndicated deals and a jump in shadow default rates

Plus, Apollo acquires a majority stake in a Spanish soccer club

Tax is your biggest expense. Stop treating it like an afterthought.

Enter Agent Tax, the modern tax strategy firm purpose-built for investment professionals.

Your dedicated expert tax advisor (yes, human) will leverage technology to proactively plan, prepare, and optimize your taxes.

On average, Agent clients have historically saved more than $80k through smarter, data-driven tax planning.

No more hourly billing. No more surprises. No more missed opportunities. Just smarter, proactive tax strategy.

Broadly syndicated PIK:

Banks are beginning to add payment-in-kind features to broadly syndicated loans as they work to remain competitive with direct lenders, according to a recent Moody's market report.

“As competition between financing markets increases, broadly syndicated lenders and high yield creditors are vying to offer borrowers the same structural features obtainable with private credit,” the Moody’s analysts wrote.

Moody’s said PIK features appeared this year in a $6.5 billion syndicated deal supporting the buyout of Skechers and in at least one bank-led refinancing of private debt over the summer.

While often cheaper than private credit, bank-led offerings tend to lack the flexibility provided by direct lenders. If syndicated deals do see wider adoption of PIK options, it could level the playing field with direct lenders and halt some of the rapid gain in market share they've experienced in recent years.

“While we have yet to see a wave of rated PIK financings, PIK features are pressing their face against the glass, so to speak, and are poised to burst through,” Moody’s said. The agency also said wider use would have ramifications for credit risk and recoveries if adoption accelerates.

But while banks are working to increase their flexibility, private credit spreads have compressed, narrowing the pricing differential versus broadly syndicated offerings.

"While LBO activity remained slow in 2024 and into 2025, the reopening of the BSL market, coupled with ample dry powder, has caused many lenders to compete aggressively for new opportunities, leading to improved deal terms for borrowers," notes Lincoln International in its latest private market perspectives report.

From the end of Q2 2025 to August 2025, private credit spreads have fallen from 475-575 bps to 450-550 bps, with all-in pricing now as low as 8.75%.

Original issue discounts have also remained historically tight, between 1 and 1.5%, with some deals forgoing an OID entirely as competitive pressures drive lender discounts.

While debt financing options across the board are becoming more attractive to sponsors, Lincoln warns against a jump in what it calls 'Bad PIK', or instances in which a PIK feature has been added to an existing facility after it initially closed — a change which indicates an amendment meant to avoid a default (by allowing the borrower to remain current by accruing PIK interest even if they are unable to pay cash interest).

With 11.4% of private credit investments featuring a PIK option and 53.3% of those options added post-close, Lincoln calculates a shadow default rate of around 6% through the end of the second quarter. This is up meaningfully from a 2021 year-end shadow default rate of just 2% (6.6% of deals featuring a PIK option, with 33.3% added post-close).

DEALS, DEALS, DEALS

• EQT agreed to invest $930 million for a 37.6% stake in Douzone Bizon, a South Korean provider of enterprise resource planning and business software solutions.

• Pfizer (NYSE: PFE) acquired obesity drug developer Metsera (Nasdaq: MTSR) for $10 billion, winning a bidding war against Novo Nordisk.

• Cenovus Energy (NYSE: CVE) will acquire oilsands producer MEG Energy for $8.6 billion following shareholder approval.

• WJ Partners invested in 7 Brew, a drive-thru beverage chain, and plans to open 100 new locations across North Carolina, South Carolina, and Georgia.

• Metropolis, an AI-powered parking platform, raised $1.6 billion, including a $500 million Series D led by LionTree and a $1.1 billion syndicated term loan led by JPMorgan.

• Investindustrial agreed to acquire TreeHouse Foods (NYSE: THS), a private-label food manufacturer, for $2.9 billion.

• Permira agreed to acquire JTC Plc (LON: JTC), a fund solutions and corporate services provider, for £2.7 billion.

• Arcline Investment Management agreed to acquire Novaria Group, a provider of aerospace components and specialized processes, for $2.2 billion from KKR.

• Apollo Global Management agreed to acquire a majority stake of around 55% in Atlético de Madrid, a Spanish soccer club, in a deal valuing the club at more than €2 billion.

• TPG submitted a binding offer of about €1 billion for the digital banking solutions unit of Italy’s payments group Nexi, per Bloomberg.

• KKR, TPG, and Warburg Pincus are in the second round of bidding to acquire Acclime, a Hong Kong-based advisory and corporate services firm, in a deal that could value the company at over $900 million, per Reuters.

• QIC and Future Fund agreed to acquire the 20% stake they didn't already own in Tilt Renewables, a clean energy developer, for A$750 million from AGL Energy (ASX: AGL).

• Dymon Asia Private Equity is considering the sale of a controlling stake in TS Group, a Singapore-based provider of foreign worker dormitories, in a deal that could be worth at least S$500 million, per Bloomberg.

• Haven Capital Partners and Altaline Capital Management formed Saratoga Compliance Solutions, an insurance compliance platform, by merging 3H Compliance Group and National Licensing Compliance Group.

• Canopy Aerospace & Defense, a portfolio company of Trive Capital, acquired Tods Technology Ltd., a UK-based designer and manufacturer of advanced composite structures and acoustic materials for maritime defense.

• Hg acquired a majority stake in Diamant Software, a German provider of accounting and financial controlling software for mid-sized companies and public-sector organizations.

• Lindsay Goldberg agreed to acquire EMCO Chemical Distributors, a Wisconsin-based industrial chemical distributor.

• NexPhase Capital acquired Always Best Care, a Rocklin, California-based franchisor of in-home senior care services, from Gemini Investors.

• Omega Systems, a Revelstoke Capital Partners portfolio company, acquired PEAKE Technology Partners, a Maryland-based healthcare managed services provider.

• Satair, an Airbus company, agreed to acquire Unical Aviation, an aerospace aftermarket solutions provider, from Platinum Equity.

• The Rapid Group, a Hidden Harbor Capital Partners portfolio company, acquired O&M Solutions, a provider of operations and maintenance services for wastewater treatment plants.

• Five Arrows, the alternative assets arm of Rothschild & Co, acquired a majority stake in NetVendor, a provider of vendor compliance management software for the multi-family and commercial real estate industries, from Greenridge Growth Partners, which retains a minority stake.

• Bonaccord Capital Partners acquired a passive minority stake in Kingswood Capital Management, a Los Angeles-based private equity firm focused on middle-market buyouts.

• IK Partners agreed to invest in Endrix, a French accountancy and advisory firm.

• Cleon Capital acquired Lexer, a Spanish legal and debt recovery services provider from Grupo BC, and Zelsior, a legaltech platform for procedural services and credit management.

• MML Keystone acquired a majority stake in Lowe Rental, a Northern Ireland-based provider of portable kitchens and catering equipment rental, from Perwyn.

• Webster Industries, a portfolio company of MPE Partners, acquired Renold, a U.K. manufacturer of industrial chain and torque transmission products.

VENTURE & EARLY-STAGE

Tech, Vertical SaaS, & Misc. Enterprise

• CoLab, an AI software for mechanical engineering and hardware development, raised $72 million in Series C funding led by Intrepid Growth Partners, with participation from Insight Partners, Y Combinator, Pelorus VC, Killick Capital, and Spider Capital.

• AirOps, a content platform for AI search, raised $40 million in Series B funding led by Greylock, with participation from Unusual Ventures, Wing Venture Capital, XFund, Village Global VC, and Frontline VC.

• Fastbreak AI, an AI sports operations platform, raised $40 million in Series A funding co-led by Greycroft and GTMfund.

Fintech

• DealMaker, a retail capital-raising platform, raised $20 million in equity and debt funding led by Information Venture Partners, with participation from CIBC Innovation Banking.

• Fomo, a crypto trading app, raised $17 million in Series A funding led by Benchmark.

• Arx Research, a crypto-fiat POS terminal company, raised $6.1 million in seed funding led by Castle Island Ventures, with participation from Inflection, Placeholder, Seed Club Ventures, and 1kx.

Consumer & Media

• Gamma, an AI visual storytelling platform, raised $68 million in Series B funding led by Andreessen Horowitz, with participation from Accel, Uncork Capital, Script Capital, South Park Commons, and Hustle Fund.

• TRIP, a calming beverage brand, raised $40 million in new funding led by Coefficient Capital.

Healthcare

• AAVantgarde Bio, a clinical-stage biotech developing inherited retinal disease therapies, raised $141 million in Series B funding, co-led by Schroders Capital, Atlas Venture, and Forbion, with participation from Amgen Ventures, Athos Capital, CDP Venture Capital, Columbia IMC, Neva SGR, Sixty Degree Capital, XGen Venture, Willett Advisors, Longwood Fund, and Sofinnova Partners.

• Neok Bio, a biotech company developing bispecific antibody drug conjugates (ADCs) for cancer, raised $75 million in Series A funding led by ABL Bio.

• Onchilles Pharma, a biotech company developing cancer therapeutics, raised $25 million in Series A1 funding from Invivium Capital, Kennedy Lewis Investment Management, UCM Ventures, LYZZ Capital Advisors, and Lincoln Park Capital Fund.

• Accipiter Biosciences, a Seattle-based biotechnology company developing novel biologics for complex diseases, raised $12.7 million in Seed funding, co-led by Takeda and Flying Fish Partners, with participation from Columbus Venture Partners, Cercano Capital, Washington Research Foundation, Alexandria Investments, Pack Ventures, and Argonautic Ventures.

Industrials, Greentech, & Other

• Terranova, a robotics startup developing terraforming robots for flood protection, raised $7 million in seed funding co-led by Congruent Ventures and Outlander VC, with participation from GoAhead Ventures, Gothams, and Ponderosa Ventures.

FUNDRAISING

• Generate Capital raised over $1 billion across its credit strategies to finance sustainable infrastructure projects.

• TELEO Capital raised $350 million for its second fund.

• Glasswing Ventures raised more than $200 million for its third fund focused on pre-seed and seed-stage investments in AI-native and Frontier Technology startups.

PARTNERSHIPS

Interested in partnering with Transacted? If you’re a financial services firm looking to connect with an engaged audience, please reach out.