- Transacted

- Posts

- Big Law in play

Big Law in play

McDermott in early-stage talks with sponsors

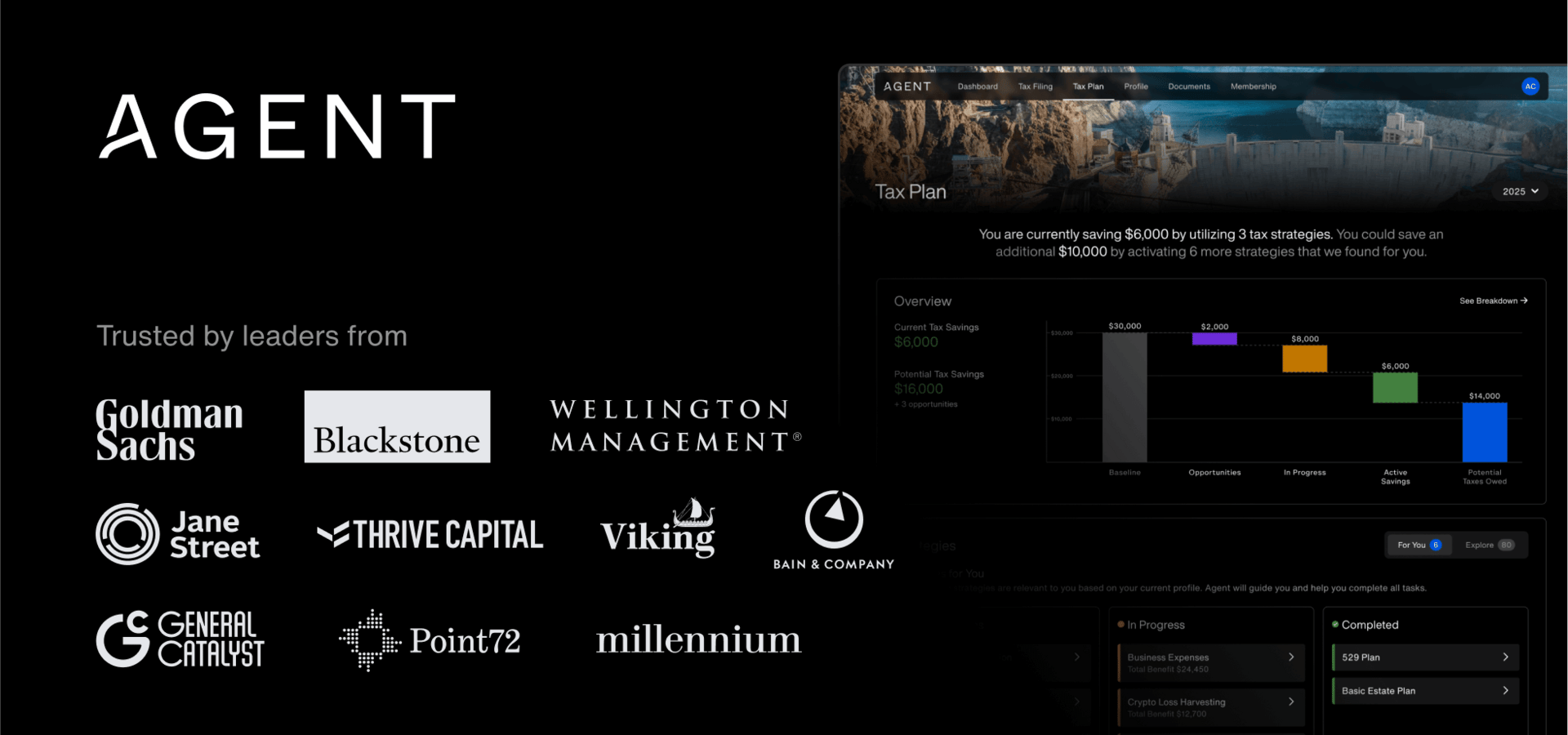

PRESENTED BY AGENT TAX

Transacted

November 18, 2025

Happy Tuesday. Here’s what we’ve got today…

A look at early sponsor interest in Big Law investments

Plus, a $6.2 billion seed round for Jeff Bezos’ latest venture

Tax is your biggest expense. Stop treating it like an afterthought.

Enter Agent Tax, the modern tax strategy firm purpose-built for investment professionals.

Your dedicated expert tax advisor (yes, human) will leverage technology to proactively plan, prepare, and optimize your taxes.

On average, Agent clients have historically saved more than $80k through smarter, data-driven tax planning.

No more hourly billing. No more surprises. No more missed opportunities. Just smarter, proactive tax strategy.

Big Law in play:

Law firm McDermott Will & Schulte said last week that it's weighing a possible stake sale to private equity after being approached by multiple suitors.

“This is all very preliminary and we are fielding inbound interest,” firm chairman Ira Coleman said in a statement. “We’re excited to learn from other leading organizations as we challenge the status quo.”

The Financial Times reported that Zack Coleman, the chair’s son, has been leading the firm's exploratory efforts, which have included preliminary work with bankers and advisers. The younger Coleman joined McDermott in July from Odyssey Investment Partners after starting his career at Moelis in 2015.

Because non‑lawyers cannot own law firms or split legal fees, any deal would require the firm to adopt a managed services structure that allows sponsor involvement while maintaining lawyer ownership.

The potential restructuring would split the business into a lawyer‑owned advisory practice and a separate managed service organization that licenses the brand and sells IT and administrative functions to the law firm. Investors would own the MSO, creating a contractual revenue stream from services purchased by the lawyer‑owned firm.

McDermott was formed this year through the combination of McDermott Will & Emery and Schulte Roth & Zabel. Its combined 2024 revenue of $2.8 billion places it among the top 20 firms globally.

While a handful of small practices have tested the controversial MSO structure, no larger firm has yet attempted the approach. If McDermott can bring on an investor without triggering the professional ethics violations opponents believe are possible, its scale could set a precedent for other Big Law firms considering similar options.

Because of these regulatory hurdles, law has remained one of the few professional services verticals without widespread private equity involvement. As that begins to change, opportunistic sponsors see a chance for early movers to get deals done at attractive valuations before the sector becomes more saturated.

Lee Minkoff, managing director at legal services-focused private equity firm Renovus Capital, told Bloomberg Law that McDermott's peers are receiving similar interest.

“All major law firms are having these conversations,” Minkoff said. “They’re not saying we should do it, they’re saying, well, we need to learn what it means and what it looks like and what others are doing.”

He also now expects the trend to happen on an accelerated timeline: “There’s been a lot of chatter in the market” about sponsor MSO investment. “I do think the MSO transactions will begin to happen in Big Law. I thought it was a couple years away. I think it could be potentially sooner.”

DEALS, DEALS, DEALS

• Goldman Sachs Alternatives acquired Burger King Japan from Affinity Equity Partners for 78.5 billion yen.

• Carlyle is exploring options to acquire Lukoil's foreign assets, which are estimated to be worth about $22 billion.

• CD&R agreed to acquire Sealed Air (NYSE: SEE), a packaging solutions provider, for $10.3 billion.

• Warburg Pincus and Permira are in talks to acquire Clearwater Analytics (NYSE: CWAN), a Boise, Idaho-based investment and accounting software maker with a $5.6 billion market capitalization.

• TotalEnergies (NYSE: TTE) agreed to acquire a 50% stake in EPH's flexible power generation platform, which includes gas-fired and biomass power plants and batteries in Western Europe, for €5.1 billion in an all-stock deal.

• Johnson & Johnson (NYSE: JNJ) agreed to acquire Halda Therapeutics, a clinical-stage biotech developing precision cancer treatments, for $3.05 billion in cash.

• Onex hired Rothschild and Morgan Stanley to advise on the sale of Tes Global, a UK-based education software provider, which could be valued at up to $2 billion, per Bloomberg.

• Grant Thornton is considering options for its Indian unit, including a minority stake sale or a merger with its U.S. or European operations, with an expected valuation of above $2 billion, per Bloomberg.

• Warburg Pincus-led investor group agreed to acquire ECN Capital (TSX: ECN), a financial services firm, for C$1.9 billion.

• Gibraltar Industries (Nasdaq: ROCK) agreed to acquire OmniMax International, a Georgia-based maker of residential roofing accessories and rainware solutions, for $1.335 billion from Strategic Value Partners.

• Blackstone Energy Transition Partners invested $1.2 billion to build a 600-MW combined-cycle natural gas power plant in West Virginia.

• Leonard Green & Partners agreed to acquire a 60% stake in Topgolf, the entertainment and driving-range arm of Topgolf Callaway Brands (NYSE: MODG), in a deal valuing the business at $1.1 billion.

• LKQ (NYSE: LKQ) is working with Bank of America to sell its Keystone Automotive Industries specialty parts division, which could be valued at around $1 billion, per Reuters.

• rPlus Energies, backed by Sandbrook Capital and Gardner Group, acquired two Idaho-based solar and storage projects, Blacks Creek Energy Center and Bluebird Solar, totaling 900 MW.

• Amundi is acquiring a 9.9% stake in London-listed Intermediate Capital Group (ICG) for an estimated £550 million, as part of a long-term strategic partnership to expand its private markets business.

• RedBird Capital Partners withdrew its £500 million bid for Britain's Telegraph Media Group.

• Versant Media Group, being spun off from Comcast Corp., hired Lazard to explore a sale of youth-sports app SportsEngine, which could be valued between $400 million and $500 million, per Bloomberg.

• York Space Systems, a space and defense firm majority-owned by AE Industrial Partners, filed for a U.S. IPO on the NYSE, which Renaissance Capital estimates could raise up to $400 million.

• Lumexa Imaging Holdings, a Welsh, Carson, Anderson & Stowe-backed diagnostic imaging provider, filed for a U.S. IPO under the ticker LMRI, with plans to raise up to $200 million.

• General Atlantic acquird a stake in SmartHR, a Japanese cloud-native human resources management platform, for $96 million from Coral Capital.

• Long Ridge Equity Partners invested $45 million in GoTu Technology, a Miami-based dental talent marketplace.

• Paramount Global (Nasdaq: PARA), Comcast (Nasdaq: CMCSA), and Netflix (Nasdaq: NFLX) are preparing bids for Warner Bros. Discovery (Nasdaq: WBD), with non-binding offers due by November 20.

• Cognizant (Nasdaq: CTSH) agreed to acquire 3Cloud, a leading dedicated Microsoft Azure services provider, from Gryphon Investors.

• Thoma Bravo acquired a majority stake in Azul, a Java development platform, from Vitruvian Partners and Lead Edge Capital, who will retain minority stakes, per Axios Pro.

• Ardurra, a portfolio company of Littlejohn & Co., acquired MKN and Associates, a California-based provider of wastewater engineering services.

• Bemberg Capital is exploring a sale of Tri-Imaging Solutions, a diagnostic imaging equipment repair company, per Axios Pro.

• Blackford Capital invested in Texas Injection Molding, a Houston-based manufacturer of injection molded industrial components.

• Copeland, a Blackstone-backed heating and cooling systems developer, confidentially filed for a U.S. IPO.

• Brean Capital is in advanced talks to acquire Janney Montgomery Scott's financial-services division, including its depository institutions advisory unit and institutional equities business, from KKR & Co. (NYSE: KKR).

• TPG and La Caisse agreed to acquire minority stakes in Pike Corporation, a Charlotte-based provider of grid infrastructure solutions for U.S. electric utilities.

• MTY Food Group (TSX: MTY), the Canadian owner of restaurant brands including Pinkberry and Cold Stone Creamery, hired TD Bank to explore a sale, per Reuters.

• Finsolutia, a Pollen Street Capital portfolio company, agreed to acquire Hipoges, a real estate and loan management platform in Southern Europe, from KKR.

• TSG Consumer made a minority investment in Pura Vida Miami, an all-day café and lifestyle brand focused on health and wellness.

• Aston Martin Lagonda (LSE: AML) denies talks with Saudi Arabia's Public Investment Fund (PIF) to be taken private, despite reports that Chairman Lawrence Stroll explored such a deal, per the Financial Times.

• Paine Schwartz Partners, through its newly launched BetterCo Holdings platform, acquired stakes in Crisp Inc., a commerce intelligence and AI platform for the global food supply chain, and Lucky Energy, a better-for-you energy drink brand.

VENTURE & EARLY-STAGE

Tech, Vertical SaaS, & Misc. Enterprise

• Thinking Machines Lab, an artificial intelligence startup founded by former OpenAI executive Mira Murati, is in talks to raise a new funding round at a roughly $50 billion valuation, per Bloomberg.

• Firmus Technologies, an AI infrastructure start-up, raised A$500 million in new funding.

• Celero Communications, developing coherent DSP technology for AI infrastructure, raised $140 million in new funding co-led by CapitalG and Sutter Hill Ventures, with participation from Valor Equity Partners, Atreides Management, and Maverick Silicon.

• Sakana AI, a Japanese artificial intelligence startup, raised $135 million in Series B funding, led by MUFG, with participation from Khosla Ventures, Macquarie Capital, New Enterprise Associates, Lux Capital, In-Q-Tel, Factorial, Fundomo, Mouro Capital, and Geodesic Capital.

• Ferroelectric Memory, a German semiconductor company developing memory chips, raised €77 million in Series C funding, co-led by HV Capital and DeepTech & Climate Fonds.

• PowerLattice, a semiconductor startup developing power delivery chiplets for AI accelerators, raised $25 million in Series A funding co-led by Playground Global and Celesta Capital.

• Span, an AI-native developer intelligence platform, raised $25 million in Seed and Series A funding from Alt Capital, Craft Ventures, SV Angel, BoxGroup, and Bling Capital.

• Peec AI, an AI search analytics platform for marketing teams, raised $21 million in Series A funding, led by Singular, with participation from Antler.

• Mate, a cybersecurity startup, raised $15.5 million in Seed funding co-led by Team8 and Insight Partners.

• PicoJool, a provider of photonics sources for AI and hyperscale data centers, raised $12 million in seed funding, led by Playground Global.

• Runlayer, an MCP security startup, raised $11 million in seed funding co-led by Khosla Ventures and Felicis.

• Reelables, a developer of smart labels for supply chain tracking, raised $10.4 million in Series A funding from Amigos Ventures, Moneta, Raptor Group, Smooth Brain, Y Combinator, and 500S.

• Hammerhead AI, an AI-powered data center power optimization platform, raised $10 million in seed funding led by Buoyant Ventures, with participation from SE Ventures, AINA Climate AI Ventures, MCJ Collective, WovenEarth Ventures, Bombellii Ventures, Clearvision Ventures, Stepchange, and Acclimate Ventures.

• Self, a zero-knowledge identity solutions provider, raised $9 million in Seed funding led by Greenfield Capital, with participation from Startup Capital Ventures x SBI Fund, Spearhead VC, Verda Ventures, and Fireweed Ventures.

• Obello, an AI graphic design platform, raised $8.5 million in Seed funding led by Obvious Ventures, with participation from Baukunst, AVV, and Preview Ventures.

• Lative, an AI-powered sales planning platform, raised $7.5 million in Series A funding, co-led by Act Venture Capital and Senovo VC, with participation from Elkstone, Enterprise Ireland, WestWave Capital, Handshake Ventures, and Shuttle.

• Shipday, a delivery and logistics platform for SMBs, raised $7 million in Series A funding, co-led by ECP Growth and Ibex Investors, with participation from B Capital and Supply Chain Ventures.

Fintech

• Ramp, a financial operations platform, raised $300 million in new funding led by Lightspeed Venture Partners, with participation from Alpha Wave Global, Bessemer Venture Partners, Robinhood Ventures, 1789 Capital, Epicenter Capital, Coral Capital, Founders Fund, D1 Capital Partners, and Coatue Management.

• Flatpay, a Danish fintech for SMB card payment solutions, raised €145 million in Growth Round funding co-led by AVP and Smash Capital, with participation from Dawn Capital and Hedosophia.

• Lighter, a crypto trading protocol and DEX on Ethereum Layer 2, raised $68 million in new funding co-led by Founders Fund and Ribbit Capital, with participation from Haun Ventures.

• Maybern, an operating system for private funds, raised $50 million in Series B funding led by Battery Ventures, with participation from Primary Venture Partners, Human Capital, MetaProp, Grafton Street Partners, and Camber Creek.

• Chargeflow, an AI chargeback automation platform, raised $35 million in Series A funding, led by Viola Growth, with participation from OpenView Venture Partners.

• Backflip, a real estate fintech company, raised $10 million in new funding, co-led by FirstMark Capital, LiveOak Venture Partners, and Vertical Venture Partners.

• Condukt, a compliance platform for financial services, raised $10 million in seed funding co-led by Lightspeed Venture Partners and MMC Ventures, with participation from Cocoa Ventures.

Consumer & Media

• Faire, an online marketplace, completed a $100 million secondary sale at a $5.2 billion valuation led by WCM Investment Management, with participation from Baillie Gifford and True North Fund.

• Agentio, an AI-native platform for creator-led advertising, raised $40 million in Series B funding, led by Forerunner, with participation from Benchmark, Craft Ventures, AlleyCorp, Antler, and Starting Line.

• CloudX, a mobile ad startup, raised $30 million in Series A funding led by Addition, with participation from DST Global, Terrain, ENIAC, Javelin, and Breakpoint Capital.

Healthcare

• Solve Therapeutics, a biotech developing antibody-drug conjugates (ADCs) for solid tumors, raised $120 million in new funding led by Yosemite, with participation from Abingworth, Ally Bridge Group, B Capital, Merck & Co., SymBiosis, General Atlantic, and Alexandria Venture Investments.

• Artios Pharma, a biotech focused on DNA Damage Response (DDR) in cancer, raised $115 million in Series D funding, co-led by SV Health Investors and RA Capital Management, with participation from Andera Partners, Avidity Partners, EQT Life Sciences, Invus, IP Group plc, Janus Henderson Investors, M Ventures, Novartis Venture Fund, Omega Funds, Pfizer Ventures, Piper Heartland, Sofinnova Partners, and Schroders Capital.

• Voize, an AI companion for nursing care, raised $50 million in Series A funding led by Balderton Capital, with participation from HV Capital, Redalpine, and Y Combinator.

• Clairity, an AI company for breast cancer risk prediction, raised $43 million in Series B funding, co-led by ACE Global Equity and Santé Ventures, with participation from the Breast Cancer Research Foundation.

• TandemAI, an AI drug discovery platform, raised $22 million in Series A extension funding co-led by KHK Fund and V-Capital, with participation from OrbiMed, Qiming Venture Partners, Chengwei Capital, and Sequoia Capital.

Industrials, Greentech, & Other

• Project Prometheus, an AI startup for the physical economy, engineering, and manufacturing, raised $6.2 billion in seed funding led by Jeff Bezos.

• KoBold Metals, an AI-driven critical minerals mining startup, raised $537 million in Series C funding, co-led by Durable Capital Partners and T. Rowe Price, with participation from Andreessen Horowitz, Breakthrough Energy Ventures, and StepStone.

• Gridware, a grid-monitoring technology company, raised $55 million in Series B funding co-led by Tiger Global and Generation Investment Management, with participation from Sequoia Capital, Convective Capital, Fifty Years, True Ventures, Lowercarbon Capital, and Y Combinator.

• Exowatt, a thermal solar provider for AI data centers, raised $50 million in Series A extension funding, co-led by MVP Ventures and 8090 Industries, with participation from Felicis, Florida Opportunity Fund, DeepWork Capital, Dragon Global, Massive VC, New Atlas Capital, BAM, Overmatch, Protagonist, and StepStone.

• ElectronX, an energy exchange for risk management in U.S. electricity markets, raised $30 million in Series A funding led by DCVC, with participation from XTX Markets, Five Rings, NGP, GTS, and JACS Capital.

• Netic, an AI company for home services like plumbing and roofing, raised $23 million in Series B funding led by Founders Fund.

• Biocentis, a biotech developing genetic insect control solutions, raised $19 million in seed funding led by The Grantham Foundation, with participation from Neurone, Corbites, NovaTerra, and Global Agri-Food Advancement Partnership.

• Endolith, a platform using AI-guided microbes to extract critical minerals, raised $13.5 million in Series A funding led by Squadra Ventures, with participation from Draper Associates, Collaborative Fund, and Overture Climate Fund.

• Bone AI, a South Korean startup developing AI-powered defense robotics, raised $12 million in Seed funding led by Third Prime, with participation from Kolon Group, Timefolio Asset Management, KNet Investment Partners, The Ventures, and Bass Ventures.

FUNDRAISING

• Diameter Capital Partners raised $4.5 billion for its third credit dislocation fund.

• Elad Gil doubled the target size of his new venture fund to nearly $3 billion from $1.5 billion, per The Information.

• Rockland Capital raised $1.2 billion for its fifth power generation and data center-focused buyout fund.

• Sofinnova Partners raised €650 million for its eleventh flagship fund focused on early-stage healthcare and life sciences.

• Ardabelle Capital, a French private equity firm founded by a former Eurazeo CEO, held a €250 million first close for its debut fund, which is targeting €500 million.

• Tailwater Capital raised at least $425 million for its fifth flagship fund focused on energy infrastructure, per the WSJ.

• Monogram Capital Partners raised $350 million for its third fund.

PARTNERSHIPS

Interested in partnering with Transacted? If you’re a financial services firm looking to connect with an engaged audience, please reach out.